If you want to start investing in trading but don’t have much experience and also want to save time to learn, copy trading will be the perfect solution to help you do that! Don’t miss the following article to learn how to use it effectively and choose the trading style that best suits you.

What is copy trading?

Copy trading is simply understood as you learn and follow the transactions of professional investors (called master traders). When they buy or sell a certain asset, you will also make similar transactions. In which:

- Signal providers are people with experience and good achievements in trading. They will share their buying and selling decisions with you.

- You will follow and follow the decisions of this good trader. Every time they buy a stock, you will also buy.

Through the trading platform, your transactions will be automatically executed according to the decisions of the good trader.

See more:

- Market Risk Mitigating and Managing Guidelines Most Simple

- Methods used to calculate effective Value at Risk Analysis

- What is Hedging? How to hedge in stock investment

- All Processes of Portfolio Management Most Effective

Benefits of copy trading

Copy trading offers many benefits to investors, especially beginners:

- You don’t need to spend too much time analyzing the market yourself, you just need to choose a reliable master and start copying.

- Easy to use, suitable for both new and experienced investors.

- You can learn a lot from the experience of successful investors.

- By spreading the risk among many different signal providers, you can minimize losses.

Cons of copy trading

Although has many benefits, it also comes with certain risks that you need to be aware of:

- Not all masters have experience and professional knowledge. Choosing an unreliable master can lead to losses.

- The master’s trading strategy may not be suitable for your investment style or goals.

- The financial market is constantly fluctuating, even professional investors cannot predict accurately.

- Unexpected events such as epidemics, wars, policy changes, etc. can greatly affect the market and cause masters to make wrong decisions.

- Putting too much capital into a single master can lead to a large risk of capital loss if that master suffers losses.

- Many new investors do not have experience in risk management, are easily swept away by the crowd and make emotional decisions.

- There are many unreliable exchanges that operate in a non-transparent manner and can steal investors’ money.

- System errors can result in incorrect or delayed transaction orders, causing losses to investors.

How to minimize risks when Copy Trading?

Before deciding to follow a master, take the time to carefully research the trading profile, investment strategy and reviews of other investors.

Don’t put all your capital into one investment strategy. Allocate capital to different masters to minimize risk.

Always monitor the performance of your investments and adjust if necessary.

Choose a licensed and trusted exchange.

Common Forms of Copy Trading

Copy Trading is increasingly diverse and developed, providing many options for investors. Below are the most popular forms of it:

Automatic Copy Trading

This is the simplest and most popular form. When you choose a professional investor to follow, all their transactions will be automatically copied to your account. You do not need to analyze the market and make decisions yourself, all transactions are performed automatically. However, you cannot customize the copied transactions.

Trading Signals

In this form, professional investors will provide trading signals (eg buy, sell, place stop loss, take profit) to followers. Followers will rely on these signals to make transactions on their own trading platform. You can better understand how professional investors make trading decisions and decide for yourself which signals to follow and adjust the order size. However, this form requires you to have basic knowledge of how to place orders and manage risks.

Social Copy Trading

This is a combination of social trading and copy trading. You can connect with a community of other investors and learn from experienced traders. You can also choose to copy part or all of an investor’s portfolio. However, you need to spend time interacting with the community and learning about other investors.

Differences Between Copy Trading and PAMM

PAMM account is a form where you give all your money to a professional asset manager. They will decide what to buy and sell, when, and you will not be able to interfere in this process.

Copy Trading is a form where you do exactly what experienced traders do before you, but you can still stop at any time if you want.

Specific comparison table:

| Features | PAMM Account | Copy Trading |

| Concept | The investor gives full control of the account to a fund manager. | The investor copies the exact trades of an experienced trader. |

| Control | The investor does not have direct control over the trades. | The investor can monitor and stop copying at any time. |

| Fees | There is usually only a fixed spread fee. | There may be a variety of fees, including spread and platform commissions. |

| Flexibility | Less flexibility because the investor cannot intervene in the trading process. | More flexibility, the investor can choose multiple providers and adjust the investment amount. |

| Transparency | There is usually less detailed information about the trades. | Information about the trades is provided transparently. |

How to start copy trading

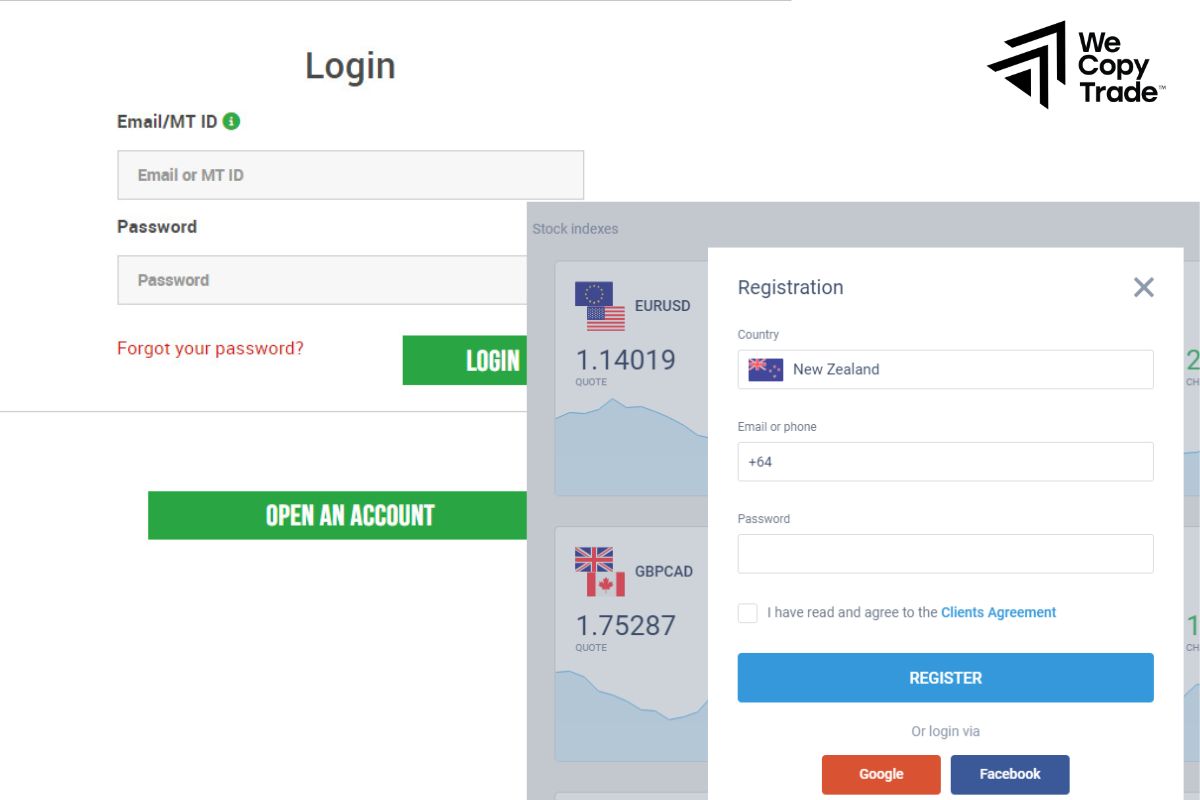

Step 1: Log in (or register) for an account:

- If you already have an account, log in.

- If you don’t, register for a new account. This process is usually quick and easy.

Step 2: Access the copy trading interface:

- Once logged in, find and click on “Copy Trading” or a similar icon.

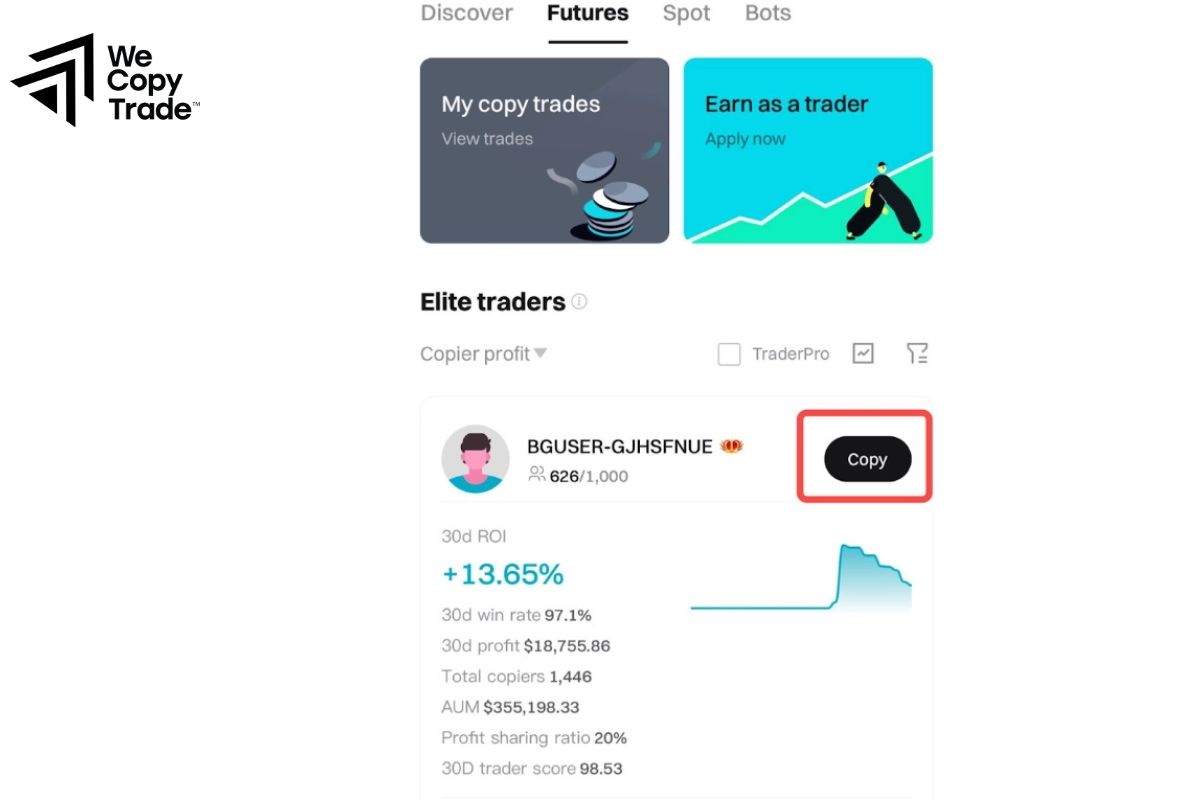

Step 3: Explore Strategy Providers

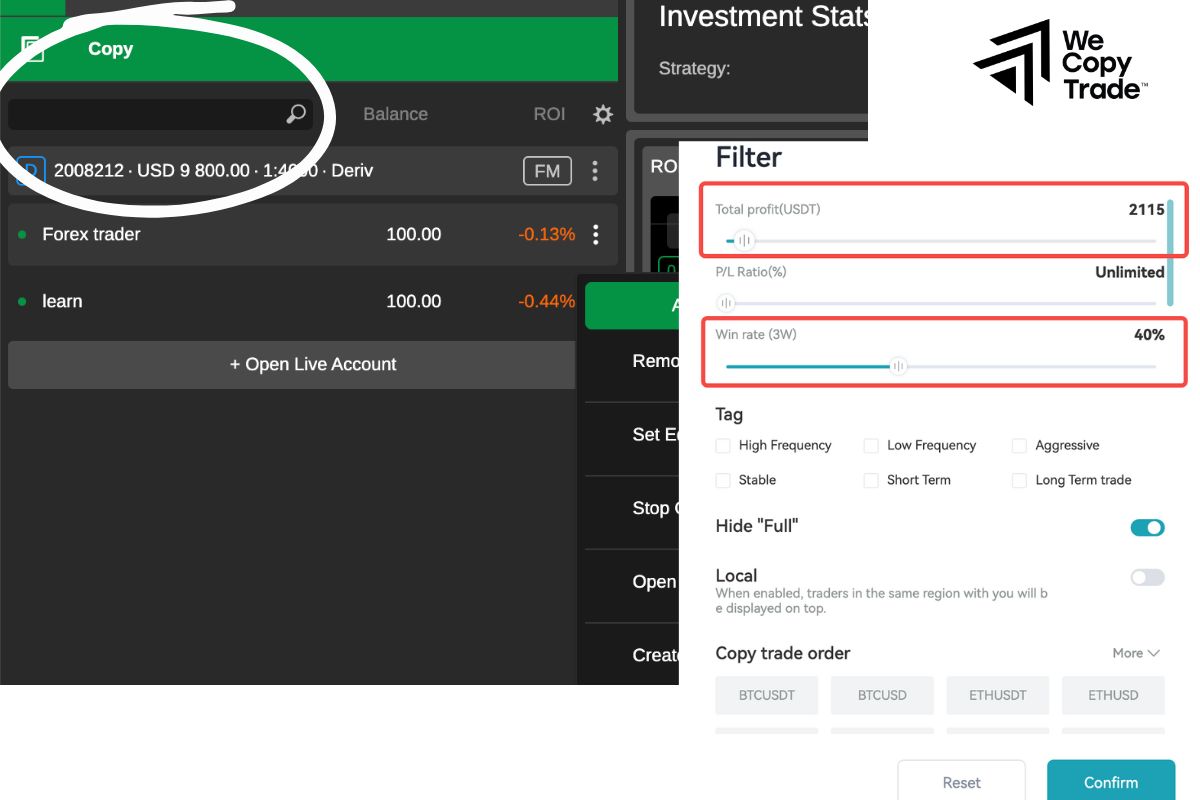

- Use the search bar to search for providers by name, trading assets, or other criteria.

- Use filters to narrow down your search results. For example, you can filter by return, risk, trading assets, etc.

- Read reviews and comments from other investors to get an overview of each provider’s performance.

Step 4: Choose a provider and start copying:

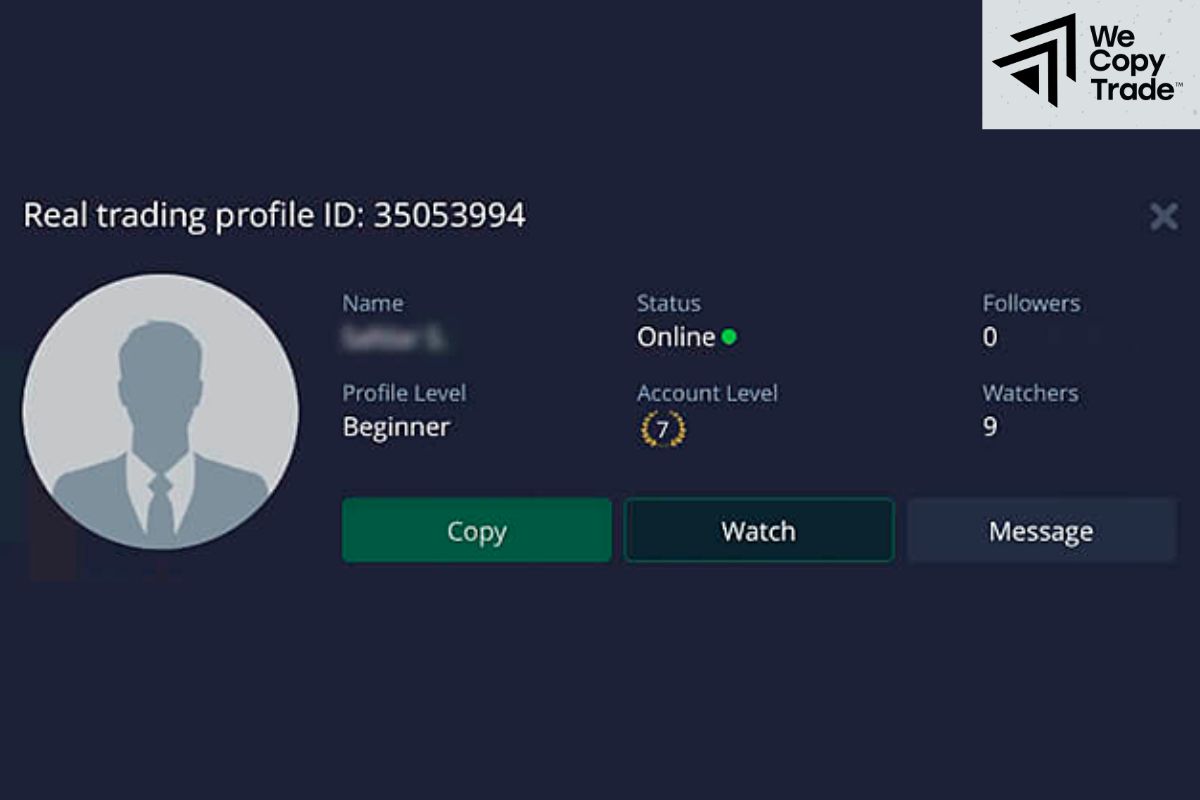

- Once you’ve found a suitable provider, click on their profile to view details.

- Click the “Start Copying” button or similar to start following that provider’s trades.

- Enter the amount you want to invest in this strategy.

Step 5: Monitor and adjust:

- You can monitor the performance of your investments through the dashboard.

- You can stop or change the investment amount at any time.

See now:

- Guide How To Check And Choose FSCA Regulated Brokers

- How to claim about Fraudulent Trading Practices at CFTC

- What is the National Futures Association? NFA license broker

- Resolving Brokers Disputes Process with the CySEC licensed

Conclusion

In conclusion, copy trading is a useful tool to help traders become more successful. However, this form has limitations that you need to be aware of to limit potential risks. Choosing which type of account depends on your goals, experience, and the level of risk you can accept. Good luck!