Currency pairs are the foundation of forex trading, representing the value of one currency relative to another. Understanding how currency work is crucial for anyone looking to succeed in the forex market. In this guide, we’ll dive into the different types of currency pairs, their significance, and strategies for trading them effectively, ensuring you have the knowledge to navigate the forex market with confidence.

What Are Currency Pairs?

Currency pairs are a fundamental concept in the forex market, representing the value of one currency relative to another. In a currency pair, the first currency listed is known as the “base currency,” while the second is called the “quote currency.”

The price of a currency pair indicates how much of the quote currency is needed to purchase one unit of the base currency. For example, in the currency pair EUR/USD, if the price is 1.20, it means that 1 Euro (EUR) is equivalent to 1.20 US Dollars (USD). Currency pairs are traded in the forex market, where traders speculate on the fluctuations in exchange rates between different currencies to make a profit.

Therefore, There are various types of currency pairs, including major pairs, minor pairs, and exotic pairs, each offering different levels of liquidity, volatility, and trading opportunities.

See now:

- What is Forex Spread? What are the Impacts and Types of Forex Spread?

- Mastering Pip Forex – How to calculate Pip in the Forex 2024

- What is Margin? The best margin stock calculation formula

- What is Financial Leverage? How to calculate the Leverage?

Classification of Currency Pairs

Currency pairs can be classified into three main categories: major pairs, minor pairs, and exotic pairs. Each category has its unique characteristics, trading volume, and market behavior.

Major Currency Pairs

- Major pairs consist of the most traded currencies globally, with the US Dollar (USD) always being part of the pair. Examples include EUR/USD, GBP/USD, USD/JPY, and USD/CHF.

- These pairs are highly liquid and have tight spreads, making them popular among traders. They are often influenced by global economic events, central bank policies, and geopolitical developments.

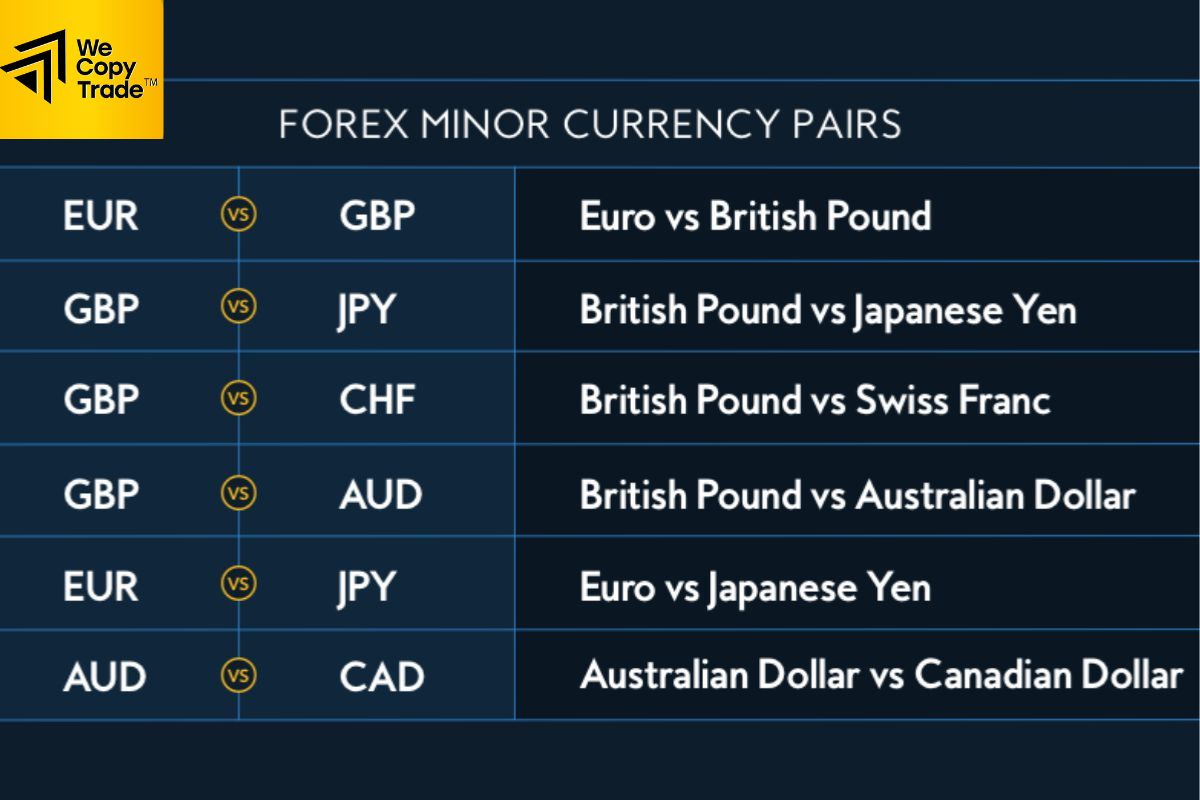

Minor Currency Pairs

- Minor pairs, also known as cross-currency pairs, involve major currencies but do not include the US Dollar. Examples include EUR/GBP, EUR/JPY, and GBP/AUD.

- These pairs are less liquid than major pairs but still offer good trading opportunities. They can be influenced by regional economic conditions and cross-border trade relationships.

Exotic Pairs

- Exotic pairs combine a major currency with a currency from a smaller or emerging market economy. Examples include USD/TRY (US Dollar/Turkish Lira) and EUR/TRY (Euro/Turkish Lira).

- These pairs are less liquid and more volatile, often with wider spreads. They can be affected by political instability, economic uncertainty, and lower trading volumes.

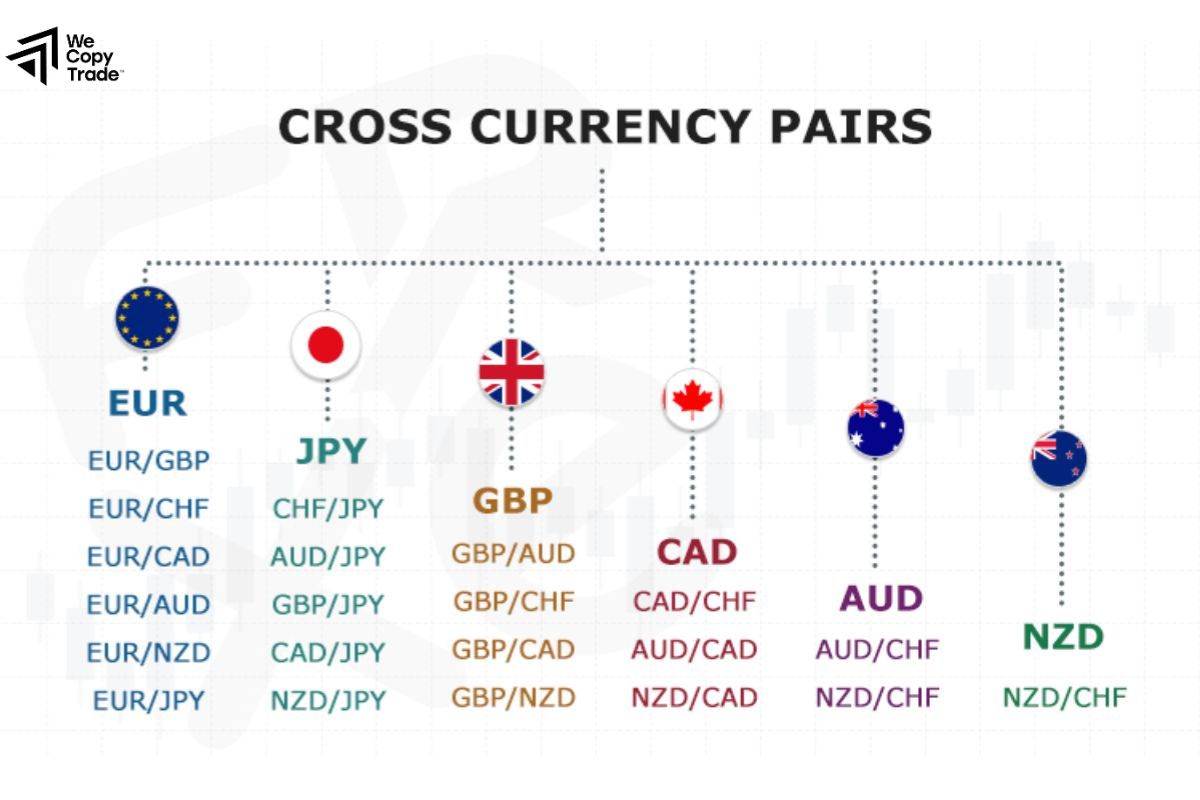

Cross Currency Pairs

- Cross currency pairs allow for direct exchange between two currencies, such as the Euro (EUR) and the British Pound (GBP), without needing to convert first to USD.

- Cross currency pairs offer diverse trading opportunities as they are influenced by regional economic conditions, central bank policies, and geopolitical events. Traders often use crosses to diversify their portfolios or to hedge against risks in major pairs.

The Importance of Currency Pairs in Forex Trading

Currency pairs play a crucial role in forex trading, serving as the foundation for all trading activities in the foreign exchange market. Here’s why currency pairs are so essential in forex trading:

- Fundamental for Trading: Currency pairs are the basic units of forex trading. Every forex transaction involves buying one currency while simultaneously selling another, making the understanding of pairs crucial for executing trades.

- Market Liquidity: Major currency pairs, such as EUR/USD and USD/JPY, are highly liquid due to their high trading volume. This liquidity ensures that traders can enter and exit positions with ease and minimal slippage.

- Price Movements and Analysis: The movements in currency pairs reflect changes in economic conditions, interest rates, and geopolitical events. Analyzing these price movements helps traders identify trends, opportunities, and risks in the forex market.

- Cross-Currency Opportunities: Cross currency pairs, which do not involve the USD, allow traders to explore additional market opportunities. These pairs can offer insights into relative currency strengths and weaknesses outside of the influence of the USD.

Tips for Trading Currency Pairs Effectively

Trading currency pairs effectively requires a combination of strategic planning, market analysis, and risk management. Here are some essential tips to help you navigate the forex market and enhance your trading success:

- First, you need to thoroughly understand the currency pairs and the factors affecting the pair you want to trade.

- Next, use charts and indicators such as moving averages and RSI to analyze trends and make decisions.

- Continue to monitor indicators by following news and economic reports that impact currency movements.

- Then, set your trading goals and strategy, focusing on using stop-loss orders to limit potential losses and manage position sizes wisely.

- Finally, use demo accounts to practice and refine your trading strategies without risking real money.

These tips will help you trade currency pairs more effectively and improve your overall trading performance.”

Examples of Currency Pairs

Here are some examples of currency pairs across different categories:

Major Currency Pairs:

- EUR/USD: Euro/US Dollar

- The most traded currency pair, representing the Euro against the US Dollar.

- USD/JPY: US Dollar/Japanese Yen

- A popular pair representing the US Dollar against the Japanese Yen.

- GBP/USD: British Pound/US Dollar

- Known as “Cable,” this pair represents the British Pound against the US Dollar.

- USD/CHF: US Dollar/Swiss Franc

- Represents the US Dollar against the Swiss Franc, often considered a safe-haven currency.

Minor Currency Pairs:

- EUR/GBP: Euro/British Pound

- Represents the Euro against the British Pound.

- EUR/AUD: Euro/Australian Dollar

- Shows the value of the Euro relative to the Australian Dollar.

- GBP/JPY: British Pound/Japanese Yen

- Represents the British Pound against the Japanese Yen.

- AUD/NZD: Australian Dollar/New Zealand Dollar

- Shows the value of the Australian Dollar relative to the New Zealand Dollar.

Exotic Currency Pairs:

- USD/TRY: US Dollar/Turkish Lira

- Represents the US Dollar against the Turkish Lira, an emerging market currency.

- EUR/TRY: Euro/Turkish Lira

- Shows the value of the Euro relative to the Turkish Lira.

- USD/SEK: US Dollar/Swedish Krona

- Represents the US Dollar against the Swedish Krona.

- GBP/THB: British Pound/Thai Baht

- Shows the value of the British Pound relative to the Thai Baht.

Conclusion

In conclusion, understanding currency pairs is essential for navigating the forex market effectively. So, Stay informed about economic indicators, utilize technical analysis, and practice with demo accounts to optimize your trading skills. With a solid grasp of currency pairs, you’ll be well-equipped to capitalize on forex market opportunities and achieve your trading goals.

See more: