A Forex demo account is an essential tool for both beginners and experienced traders. It provides a risk-free environment to practice trading strategies, test market conditions, and understand the dynamics of Forex trading without any financial commitment. So, follow this article to improve your skills to succeed in the Forex market.

What is a Demo Account in Forex?

A demo account in Forex is a simulated trading account provided by Forex brokers that allows you to practice trading without risking real money.

- Simulated Environment: The demo account mimics real market conditions, but you use virtual money.

- Virtual Funds: You don’t risk real money, which lets you learn and experiment without financial risk.

- Practice and Learning: It’s an excellent tool for beginners to learn trading and get familiar with the trading platform.

- Platform Familiarity: Helps you get used to the features and tools of the trading platform.

See now:

- The most effective way to master a live account in stocks

- Instructions how to use the Economic Calendar updated daily

- What is Financial News in Forex? How to Read New Effectively

Why Use a Demo Account?

To use a forex demo account most effectively, follow the factors below:

- Learning and Familiarization: A demo account helps new traders understand how Forex trading works, including the mechanics of trading platforms and the fundamentals of trading strategies.

- Testing Strategies: Experienced traders use demo account to test new trading strategies and techniques without financial risk.

- Platform Familiarity: It provides an opportunity to become comfortable with the trading platform and tools, ensuring smooth operation when trading with real money.

- Risk Management: Demo account help traders understand and practice risk management techniques, such as setting stop-loss orders and managing trade size.

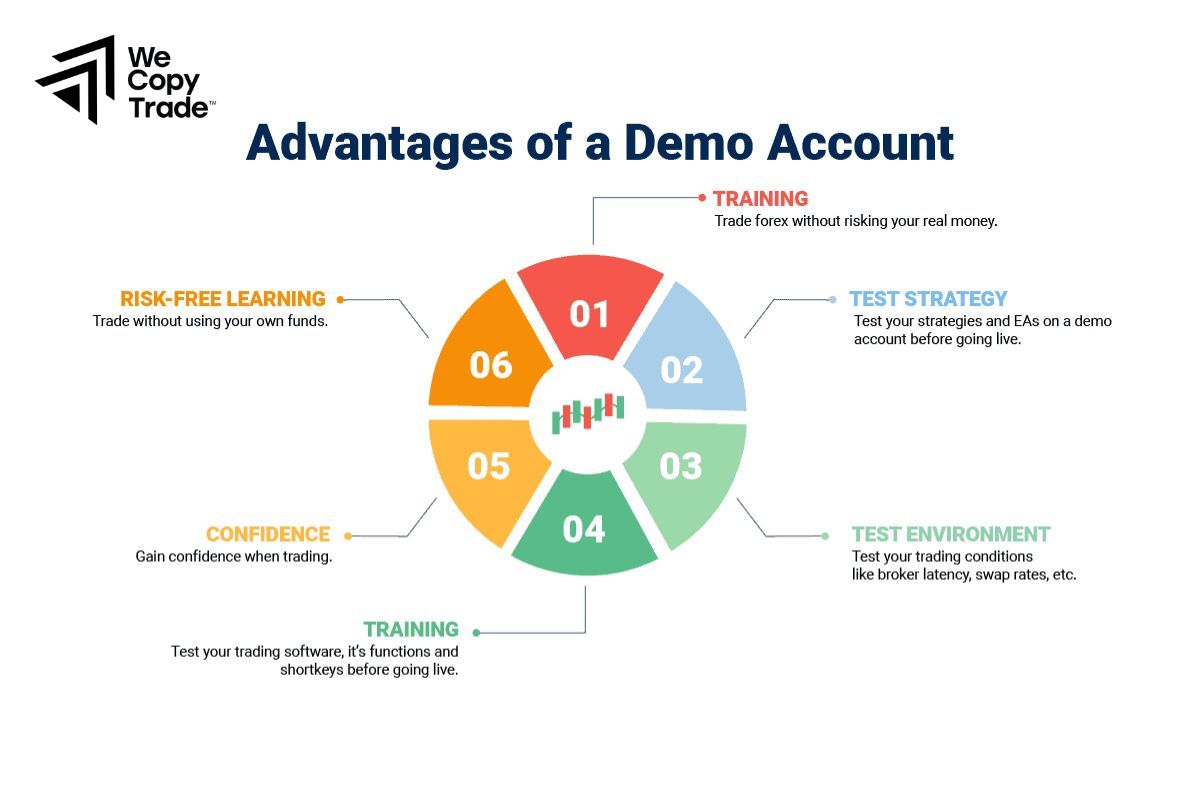

Benefits of Using a Demo Account

Using a demo account offers several key benefits:

- Risk-Free Practice: You can practice trading strategies and learn the platform without risking real money. This allows you to build confidence and gain experience without financial loss.

- Platform Familiarization: Helps you get comfortable with the trading platform’s features and tools, making it easier to navigate and use a demo account effectively when you switch to a live account.

- Strategy Testing: You can test different trading strategies and techniques to see what works best for you, helping to refine your approach before committing real funds.

- Market Understanding: Provides an opportunity to understand market conditions, price movements, and trading dynamics in a risk-free environment.

- Confidence Building: By practicing and seeing your trades in action, you can build confidence in your trading skills and decision-making abilities.

- Learning Experience: Offers a valuable learning experience for new traders, helping them understand how trading works, including risk management and order execution.

How to Choose a Demo Account in Forex

Choosing the right demo account for Forex trading is crucial for your learning experience and overall trading success. Here’s a detailed guide to help you select the best demo account for your needs:

Check Broker Reviews

Look for reviews and feedback from other traders about the broker. This will give you insights into their reliability and customer service.

Verify Regulation

Ensure the broker is regulated by a reputable financial authority. Regulation adds a layer of security and ensures the broker adheres to industry standards.

Assess Broker’s Longevity

Consider brokers with a long track record, as they are likely to provide a stable and reliable trading environment.

Assess Platform Features

Verify if the demo account uses the same trading platform as the live account. Popular platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

Analyze Account Conditions

Choose a demo account that mirrors live market conditions as closely as possible. Some demo accounts may use simulated prices that differ from actual market conditions.

Best Forex Demo Accounts

Here are some top Forex demo accounts to help you practice trading effectively:

MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

- Brokers: IG Group, OANDA, Admiral Markets

- Features: Real-time quotes, advanced charting, and a wide range of indicators.

cTrader

- Brokers: IC Markets, Pepperstone

- Features: Advanced order execution, customizable charts, and user-friendly interface.

TradingView

- Brokers: Forex.com, OANDA

- Features: Sophisticated charting, real-time data, and integration with broker’s services.

Thinkorswim

- Brokers: TD Ameritrade

- Features: Advanced charting tools, customizable interface, and paper trading.

Tips for Maximizing Your Demo Account Experience

To get the most out of your Forex demo account, consider these tips:

- Approach demo trading with the same discipline as live trading.

- Experiment with and analyze different trading strategies.

- LeGet comfortable with all features and tools.

- Use stop-losses, take-profits, and adjust position sizes.

- Understand that demo environments may differ from live markets.

- Work on managing emotions and stress.

- Define and track clear objectives for your demo trading.

Frequently Asked Questions

What is the best Forex demo account for beginners?

For beginners, the best Forex demo account are:

- MetaTrader 4 (MT4): IG Group, OANDA and user-friendly, extensive educational resources.

- MetaTrader 5 (MT5): Forex.com, XM and advanced features with beginner-friendly tools.

- Plus500: Simple, easy-to-use interface.

How long should I use a demo account before switching to a live account?

The ideal duration for using a demo account before transitioning to a live account varies based on individual readiness and goals. However, here are some general guidelines:

Master the Basics

- Timeframe: 1-3 months

- Goal: Ensure you understand how the trading platform works, basic trading concepts, and how to execute trades.

Develop a Strategy

- Timeframe: 2-6 months

- Goal: Test and refine your trading strategy on the demo account, ensuring it’s profitable and suits your trading style.

Simulate Real Conditions

- Timeframe: A few weeks

- Goal: Trade with realistic conditions, including managing emotions and risk, to prepare for live trading.

Prepare for Transition

- Timeframe: 1-2 weeks

- Goal: Review your demo trading results, assess your readiness, and start with a small live account to manage risk effectively.

Can I use a demo account for automated trading?

Yes, you can use a demo account for automated trading. A demo account allows you to practice and test your automated trading strategies without risking real money. Additionally, you can implement your automated trading strategies with a demo account. This lets you observe how your strategies perform in a simulated environment before committing real capital.

Conclusion

In conclusion, utilizing a demo account is an essential step for anyone looking to refine their automated trading strategies.So, embracing the benefits of an account will help you build confidence, make informed decisions, and ultimately achieve greater success in your trading endeavors.

See more: