Why is the price of a phone different in Vietnam and the US? The answer lies in the fluctuation of exchange rates. Let’s find out more below!

What is an Exchange Rate?

An exchange rate is essentially the price of one currency in terms of another. It reflects the value of a nation’s currency relative to other currencies.

The exchange rate between two currencies is the result of the interaction of many economic factors, including interest rates, economic growth, and the labor market conditions of each country. This type of exchange rate is often referred to as the market rate. Exchange rates are expressed in currency pairs, such as EUR/USD, in which the first currency (EUR) is exchanged for the second currency (USD).

Exchange rates play a crucial role in:

- International trade: A strong currency makes imports cheaper and exports more expensive, affecting a country’s trade balance.

- Tourism: A strong currency attracts more tourists, while a weak currency can make a country more affordable for foreign visitors.

- Consumer prices: Exchange rates influence the prices of imported goods and services that consumers pay.

Example:

If the exchange rate between the US dollar and the euro is 1.07, it means that 1 euro can be exchanged for 1.07 US dollars.

See more:

- What is Forex? Secrets to Successful Trading for beginners

- What is Forex Spread? What are the Impacts and Types of Forex Spread?

- Mastering Pip Forex – How to calculate Pip in the Forex 2024

Classification of Exchange Rates

Exchange rates can be classified into two main categories:

Floating exchange rates

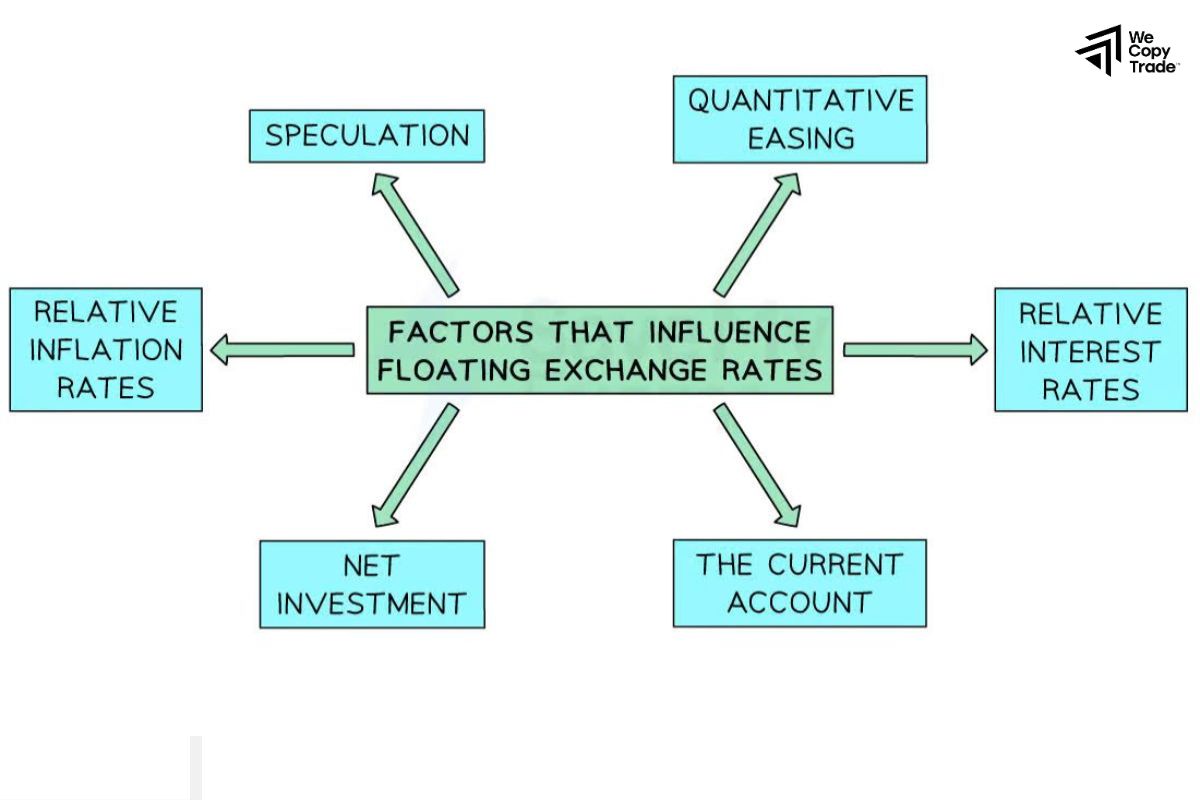

These currencies are determined by market forces of supply and demand in the foreign exchange market. The value of a floating currency can rise or fall freely based on economic factors.

Under this system, when supply exceeds demand, prices tend to fall and vice versa. The strength of a currency depends not only on economic fundamentals but also on investor sentiment. If the belief of a country’s economy declines, its currency will be sold off, leading to a depreciation. However, governments can use tools such as open market intervention, interest rate adjustments or changes in fiscal policy to influence exchange rates.

Fixed exchange rates

These currencies are pegged to the value of another currency or a basket of currencies. A pegged currency’s value is maintained within a specific range. For example, the Hong Kong dollar is pegged to the US dollar.

By providing a stable and predictable business environment, fixed interest rates encourage investment, promote growth and help governments control inflation effectively.

What are the factors that influence an Exchange Rate?

Economic Indicators

- Interest rates: Higher interest rates encourage foreign investment, boosting the currency.

- Inflation: High inflation weakens a currency as it reduces its purchasing power.

- GDP growth: A strong economy with high GDP growth can strengthen a currency.

- Trade balance: A trade surplus (exports exceed imports) can strengthen a currency.

Political Stability

- Political uncertainty: Political instability can weaken a currency.

- Government policies: exchange rates can be impacted by fiscal and monetary policies

Global Events

- Wars, natural disasters, and trade disputes: These events can disrupt economies and influence exchange rates.

Speculation

- Investor sentiment: The expectations of traders and investors can drive currency movements.

- Currency carry trade: Borrowing in a low-interest-rate currency and investing in a high-interest-rate currency.

How to Present Exchange Rates

Exchange rates are expressed as a currency pair, such as USD/GBP. The first currency listed (USD) represents one unit of that currency. The exchange rate tells you how much of the second currency (GBP) you need to purchase one unit of the first currency.

Example:

If the USD/GBP exchange rate is 0.80, it means that 1 US dollar equals 0.80 British pounds. To calculate the cost of 100 US dollars in British pounds, you would multiply:

- 100 USD x 0.80 GBP/USD = 80 GBP

Converting currencies:

To convert one currency to another, simply multiply the amount of the first currency by the exchange rate.

Example:

- Converting pounds to euros: If you have £400 and the exchange rate is 1 GBP = 1.19 EUR, then you can convert your pounds to euros by multiplying:

- £400 x 1.19 EUR/GBP = €476

- Converting euros to pounds: If you need to pay €500 in rent and the exchange rate is 1 EUR = 0.84 GBP, you can calculate the equivalent amount in pounds by multiplying:

- €500 x 0.84 GBP/EUR = £420

Other Related Terms to Exchange Rates

You want to invest in the forex market but feel overwhelmed by the technical jargon? Don’t worry, this article will help you clarify the basic concepts so you can confidently make your investment decisions.

- Value Spot: The exchange of currencies on the same business day as the trade is entered.

- Value Today: Same as Value Spot.

- Value Tomorrow: The exchange of currencies one business day after the trade date.

- FX Confirmation: A document confirming the details of an FX transaction.

- Trade Date: The date the FX transaction is executed.

- Settlement Date: The agreed date for the exchange of currencies.

- Business Day: A weekday that is not a public holiday in either currency.

- Cut Off Time: The deadline for a payment to be processed on the same business day.

- Currency Pair: The two currencies involved in an FX transaction (e.g., USD/EUR).

- Exchange Rate: The price of one currency expressed in terms of another.

Conclusion

In conclusion, exchange rate fluctuations have profound effects on the economy of millions of people around the world. Let’s update your knowledge about exchange rates daily so as not to miss out on profit opportunities as well as minimize risks when investing.

See now: