In recent years, the prop trading model has emerged as an attractive trend, not only for seasoned traders but also appealing to recent graduates and self-taught individuals seeking prop firm career opportunities in the financial sector. So, what exactly are these prop firm career opportunities? How can one get involved and build a career here? This article will provide you with a comprehensive, easy-to-understand, and practical overview.

What is Proprietary Trading?

Proprietary trading, or prop trading, is a form where a trader uses the prop firm’s capital to buy and sell financial products (stocks, futures, options, cryptocurrencies, etc.) to seek profits. Unlike individual investors or asset management firms that manage funds on behalf of clients, traders at prop firms trade for the benefit of the company itself and are rewarded based on their individual performance.

This is an extremely competitive environment, but it’s also one that encourages capability and flexible thinking – a big plus for those who want to advance based on their true merit. Understanding this distinction is key to navigating prop firm career opportunities.

See more:

- Prop Firm Investment Opportunity – A New Path for Beginners

- Career Development in Prop Firms: Unlimited Opportunities for the Modern Trader

- Prop Firm Support Services: Your Path to Success

Common Types of Prop Firms Today

Currently, there are three main types of prop firms in the market:

- Churn-and-burn firms: These often require high “training” fees, offer no base salary, and you only keep profits if you exceed very high thresholds. These are generally unreliable firms and not where genuine prop firm career opportunities lie.

- Semi-professional firms: They give you access to trading systems but charge monthly fees (for data, platforms). While seemingly more “legitimate,” the financial risk often still lies with you.

- Professional, legitimate prop firms: These provide real capital, training, offer a base salary, and performance-based bonuses. This is the best environment to pursue long-term prop firm career opportunities.

Who Are Prop Firm Career Opportunities For?

Traders – The Central Role

This is the most common and talked-about position. You can become a:

- Quantitative Trader (Quant Trader): Applies mathematical models and programming to make trading decisions.

- Discretionary Trader: Relies on intuition, experience, and manual analysis for trading.

In most modern prop firms, this boundary is blurring as today’s traders are expected to understand at least some concepts of coding and data. This evolving skill set is vital for prop firm career opportunities.

Other Related Roles

- Quant Researcher: Builds mathematical models to support trading.

- Software Developer: Develops systems and algorithms for traders.

- Operations, Compliance, and HR Departments: While not directly involved in trading, these are indispensable departments in large-scale prop firms.

In summary, prop firm career opportunities are not just for skilled traders but also extend to technical and management roles.

Salary and Career Progression

One of the most attractive aspects of prop firm career opportunities is the competitive salary and performance-based bonuses:

- Entry-level Traders: $100,000–$200,000/year

- Experienced Traders: $200,000–$500,000/year

- Senior Traders or Partners: $500,000–over $1 million/year

Note: At a prop firm, you are typically paid in cash rather than equity or deferred bonuses. This provides a significant financial liquidity advantage in the early stages of your career.

Furthermore, if you are truly capable, you can advance quickly – potentially even becoming a Partner after 3–5 years, which is rarely achievable at traditional investment banks. This rapid progression is a significant draw for prop firm career opportunities.

Essential Skills for Pursuing Prop Firm Career Opportunities

Regardless of whether your background is in finance, mathematics, physics, or computer science, if you possess the following capabilities, prop firm career opportunities are widely open:

- Sharp Logical Thinking and Probabilistic Acumen: The ability to think critically and understand probabilities is fundamental.

- Ability to Work Under High Time Pressure: The trading environment is fast-paced and demanding.

- Discipline in Risk Management: Strict adherence to risk rules is non-negotiable.

- Programming Skills are a Big Plus (Python, C++): Automation and data analysis are increasingly important.

- A Spirit of Continuous Learning and Quick Strategy Adaptation: Markets evolve, and so must traders.

Factors like academic degrees or GPA (grade point average) are secondary. What matters is demonstrating tangible results and a suitable mindset.

The Modern Prop Firm Onboarding Process

In contrast to traditional financial institutions that require CVs, degrees, or interviews, modern prop firm models – especially at firms like WeMasterTrade – have opened up a completely different path: they evaluate actual trading results, not academic or professional resumes.

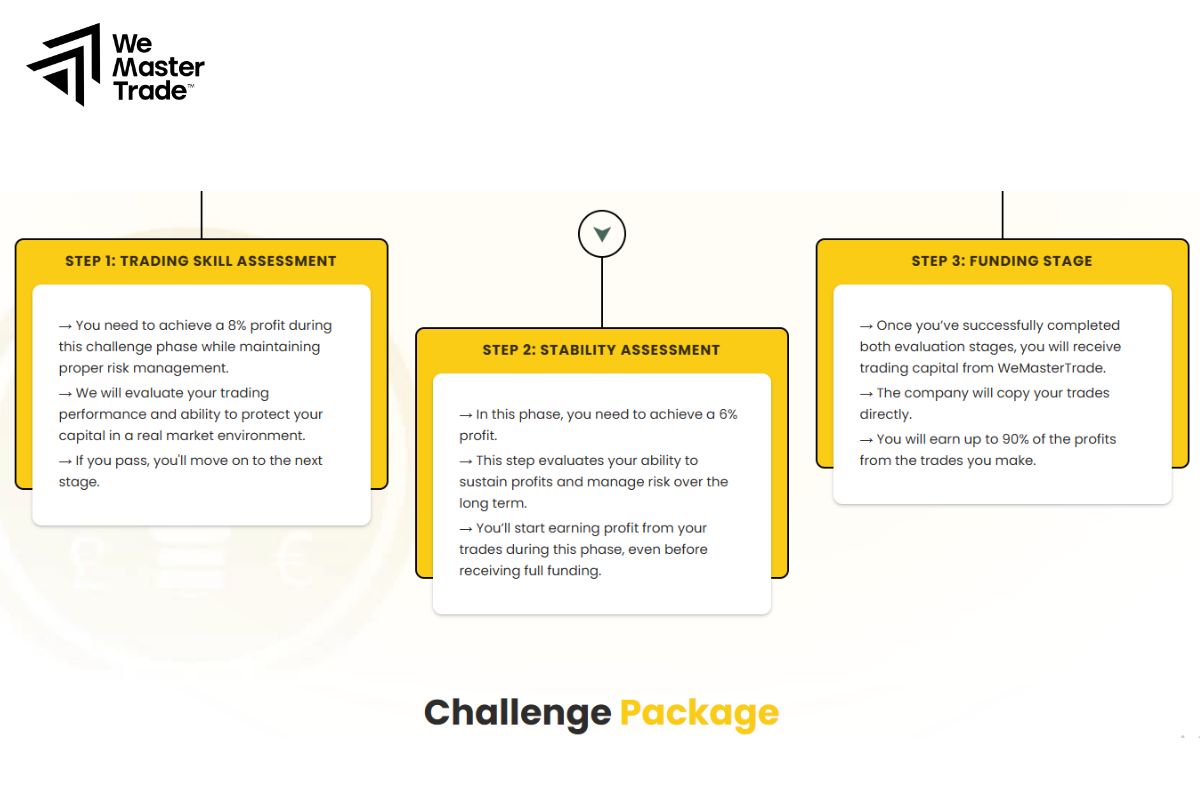

For Evaluation Accounts (Challenges)

This is the most common form, simulating a real trading environment to assess a trader’s capabilities. You need to meet several technical conditions:

- Achieve a target profit within allowed drawdown limits.

- Adhere to risk management rules: daily loss, overall loss.

- Trade for a sufficient number of days to ensure your system isn’t just “lucky.”

If you complete the challenge: You will be provided with real capital and begin your journey of receiving regular payouts from the profits you generate.

For Instant Funding Accounts

With this model, you are immediately provided with capital without needing to pass a challenge. After meeting some simple conditions, such as trading for enough days and generating real profits, you can withdraw money directly from the account.

No Interviews, No Psychological Tests – Just Real Performance

This is a key differentiator for prop firms like WeMasterTrade: traders are evaluated by their actions – not their words.

- You don’t need a polished CV; you just need a trading system with clear logic.

- You don’t need a professional degree; you just need to know how to manage risk and control your emotions.

- You don’t need to be a good speaker – but you must know how to journal and analyze your past trades.

So, What Do You Need to Prepare?

Even though the process might seem simpler, to trade successfully and sustain a long-term career at a prop firm, traders still need:

- A trading strategy verified through backtesting or demo trading.

- Trading discipline – knowing when to stop and not breaking your system.

- Clear capital management, knowing how to control drawdown and scale appropriately.

- The ability to analyze the market, multiple timeframes, and price action – rather than relying solely on indicators.

Challenges and Risks to Consider

Not everyone is suited for the prop trading environment. Before entering, you need to consider:

- High termination rates if you don’t generate consistent profits.

- Significant psychological pressure when trading with real money.

- Fewer career transition opportunities if you don’t succeed in trading.

- Some prop firms are illegitimate, easily scamming for “training” fees or demanding unreasonable charges.

Therefore, thoroughly research the company before joining. Only choose prop firms that offer realistic training programs, provide real capital, and ideally, offer a base salary.

Conclusion

In conclusion, prop firm career opportunities are expanding rapidly with advancements in technology, data, and the demand for practical trading talent. If you are serious about trading, start preparing today: learn programming, practice probabilistic mathematics, trade personal accounts, and most importantly, build the mindset of a professional trader. This diligent preparation will pave your way to successful prop firm career opportunities.

See more: