In today’s fast-paced world, staying up to date with the latest financial news is crucial to making informed decisions in both personal and professional finance. Therefore, it is important to regularly access accurate and up-to-date news to gain valuable insights into market dynamics and future economic changes.

What is Financial News in Forex?

In the Forex market, financial news plays a crucial role in predicting currency rate fluctuations. Financial news includes economic data such as GDP growth rates, unemployment figures, and inflation, which help traders assess the economic health of a country. Information from central banks, like interest rate decisions and monetary policy, can also significantly impact currency values.

Additionally, political events, international trade, and global market fluctuations affect exchange rates. Therefore, keeping up with financial news is essential for Forex traders to make accurate and timely decisions.

See now:

- The most effective way to master a live account in stocks

- What is a Demo Account? How to Choose an Account in Forex

- Instructions how to use the Economic Calendar updated daily

- What is a Central Bank? Its role in the economy 2024

Importance of Staying Updated with Financial News

Staying updated with financial news is essential for several reasons:

- Informed Decision-Making: Financial news provides critical information on economic trends, market conditions, and policy changes. This helps investors, businesses, and individuals make well-informed decisions about investments, financial planning, and strategic business moves.

- Market Awareness: Understanding current events and economic indicators helps you stay aware of market dynamics and potential risks. This knowledge allows for better anticipation of market movements and can lead to more effective trading and investment strategies.

- Risk Management: Financial news can highlight potential risks and opportunities in the market. By staying informed, you can adjust your strategies to mitigate risks or capitalize on emerging opportunities.

- Economic Forecasting: News on economic reports, central bank actions, and geopolitical events helps in forecasting future economic conditions. This forecasting is crucial for long-term financial planning and investment strategies.

- Competitive Advantage: For businesses, being aware of financial news provides insights into market trends, consumer behavior, and economic conditions, offering a competitive edge in making strategic decisions and adapting to changing environments.

- Confidence and Preparedness: Regularly updating yourself with financial news builds confidence in your financial decisions and ensures you are prepared for sudden changes in the market or economic landscape.

How to read Stock Market News Effectively

To read stock market news effectively, you can follow these steps:

Choose Reliable Sources

Read news from reputable sources like Bloomberg, CNBC, or Reuters to ensure accurate and timely information.

Understand Key Metrics

Familiarize yourself with key metrics and terminology such as earnings reports, P/E ratios, and market capitalization. Understanding these terms will help you interpret the news more easily.

Focus on Market Trends

Look for news related to overall market trends rather than just isolated events. These trends can affect multiple stocks or sectors.

Pay Attention to Economic Indicators

News about economic indicators like GDP growth, unemployment rates, and inflation can impact stock prices. Knowing these indicators helps you understand market sentiment.

Analyze Company-Specific News

When reading Financial News about specific companies, pay attention to factors like earnings reports, management changes, and new products. Consider how these factors might affect the company’s stock price.

Consider Market Reactions

Observe how the market reacts to news. Changes in stock prices can indicate investor sentiment and market expectations.

Use News in Conjunction with Other Tools

Combine news with technical and fundamental analysis tools to get a more comprehensive view of the market.

Be Aware of Timing

Consider the timing of news releases. News announced during trading hours can cause immediate volatility, while news released after hours may impact the next trading day.

Stay Updated Regularly

The stock market is constantly changing. Regular updates help you stay informed about the latest developments and adjust your strategy accordingly.

Forex Market Trend Analysis Tools

Analyzing market trends in Forex involves using various tools and techniques to understand price movements and predict future trends. Here are some essential Forex market trend analysis tools:

- Relative Strength Index (RSI): Measures the speed and change of price movements. RSI values range from 0 to 100, with readings above 70 indicating overbought conditions and readings below 30 indicating oversold conditions.

- Moving Average Convergence Divergence (MACD): A trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. It helps identify potential buy and sell signals.

- Bollinger Bands: Consists of a middle band (SMA) and two outer bands that are standard deviations away from the middle band. It helps identify volatility and potential overbought or oversold conditions.

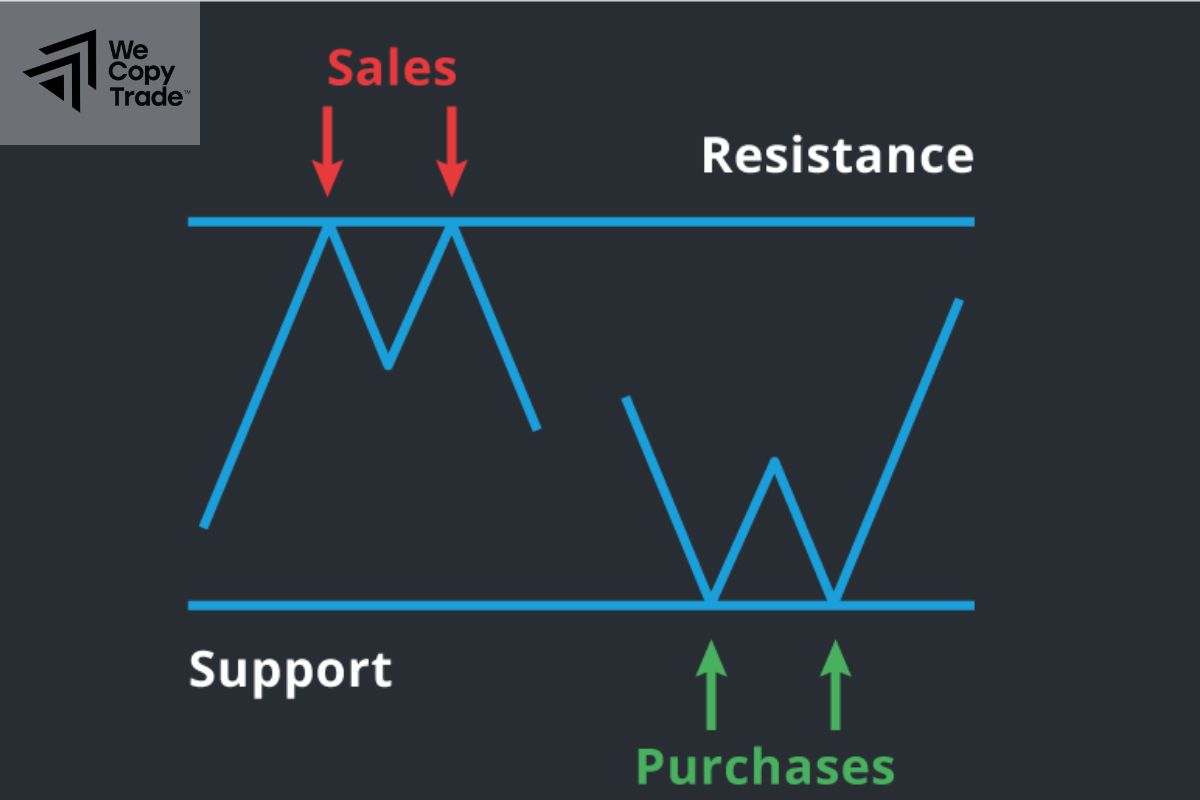

- Fibonacci Retracement: Uses horizontal lines to indicate areas of support or resistance at the key Fibonacci levels before the price continues in the original direction.

Conclusion

In conclusion, staying up to date with financial news is extremely important for anyone involved in the financial markets. To maximize the benefits of financial new, you need to take advantage of key figures, economic indicators, and market reactions. This information will help you better understand the financial landscape and make informed decisions. Don’t miss the opportunity to incorporate Forex news into your strategy; this will help you accurately predict market movements and achieve your financial goals with greater confidence.

See more: