Do you want to know the secrets to successful trading planning? Backtesting is a perfect choice to answer this question. Do you often review your strategy results to learn from experience? This is how this model works. To know how to backtest on MT4, let’s find out right away!

What is Backtesting?

Backtesting is a way to test whether an investment strategy actually works before putting it to real money. By using historical market data, we can “go back in time” and see how the strategy would have performed. If the strategy was profitable in the past, there is a good chance that it will perform well in the future.

See more:

- Step-by-step Guide using MT4 Demo Account Guide In 5 Minutes

- MT4 For Mobile Trading Platform – How to Download MT4

- MT4 Account Types – Which is Better for Forex Trading?

- Discover the top 12 popular and effective MT4 indicators

Importance of backtesting in trading

Backtesting is an indispensable tool for any trader. It helps traders:

- Identify the strengths and weaknesses of a strategy. This allows you to adjust your strategy accordingly.

- Help you assess your risk level, understand the potential for loss of your strategy, and plan a suitable risk management plan.

- Once you have proven the effectiveness of your strategy, you will be more confident when trading in real life.

- Avoid costly mistakes in terms of time and money when trading in real life.

To perform backtesting, investors will use specialized software to simulate the trading process based on historical data. This software will calculate the strategy’s profit, risk, and other indicators. Investors will then analyze the results to evaluate the strategy’s effectiveness and adjust parameters if necessary.

The Benefits and Risks of Backtesting

Here are the two sides of backtesting tools that you need to be aware of:

The Benefits of Backtesting

Backtesting is a useful tool that helps you evaluate the effectiveness of an investment strategy before applying it in practice. Thanks to backtesting, you can:

- Save money by eliminating ineffective strategies before investing real money.

- Investors will have a better understanding of the market and the factors that affect it.

- Improve your skills to become a more experienced and confident investor.

- Provide enough information to make the right investment decisions.

Disadvantages of backtesting

Backtesting is a useful tool but also has limitations. Historical data may not fully reflect the complex fluctuations of the market, and careless data selection can lead to misleading results. When using backtesting, investors need to pay attention to the following issues:

- Do not hastily select data to prove your point.

- Exploiting too many hypotheses can lead to inaccurate results.

- The market is always changing, and there are many unpredictable factors that can influence its direction. This means that past performance is not necessarily indicative of future results.

- It is necessary to calculate all costs to accurately evaluate the effectiveness of the strategy.

- Backtesting relies on historical data, which may not accurately reflect current market conditions

- Optimization Risk: Optimizing too many parameters can lead to overfitting, causing a strategy to perform well on historical data but underperform in real markets.

You should combine backtesting with other factors such as market knowledge, personal experience and fundamental analysis to make the final decision accurately.

Comparison of the three methods

There are actually many ways to evaluate an investment strategy. Backtesting, scenario analysis, and forward-looking performance testing are three of the most popular. Let’s compare and highlight the unique features of these methods:

Backtesting vs Scenario Analysis

Backtesting and scenario analysis are two complementary tools in investing that help us learn and improve. However, how to backtest on MT4 the way they work has its own unique characteristics such as:

- Backtesting helps us see how an investment strategy has performed in the past. From there, we can see the strengths and weaknesses of the strategy to find solutions to promote or overcome in time.

- Scenario analysis is like predicting the outcome of an upcoming transaction. You will set up many different types of situations and prepare for unexpected situations that may occur in the market.

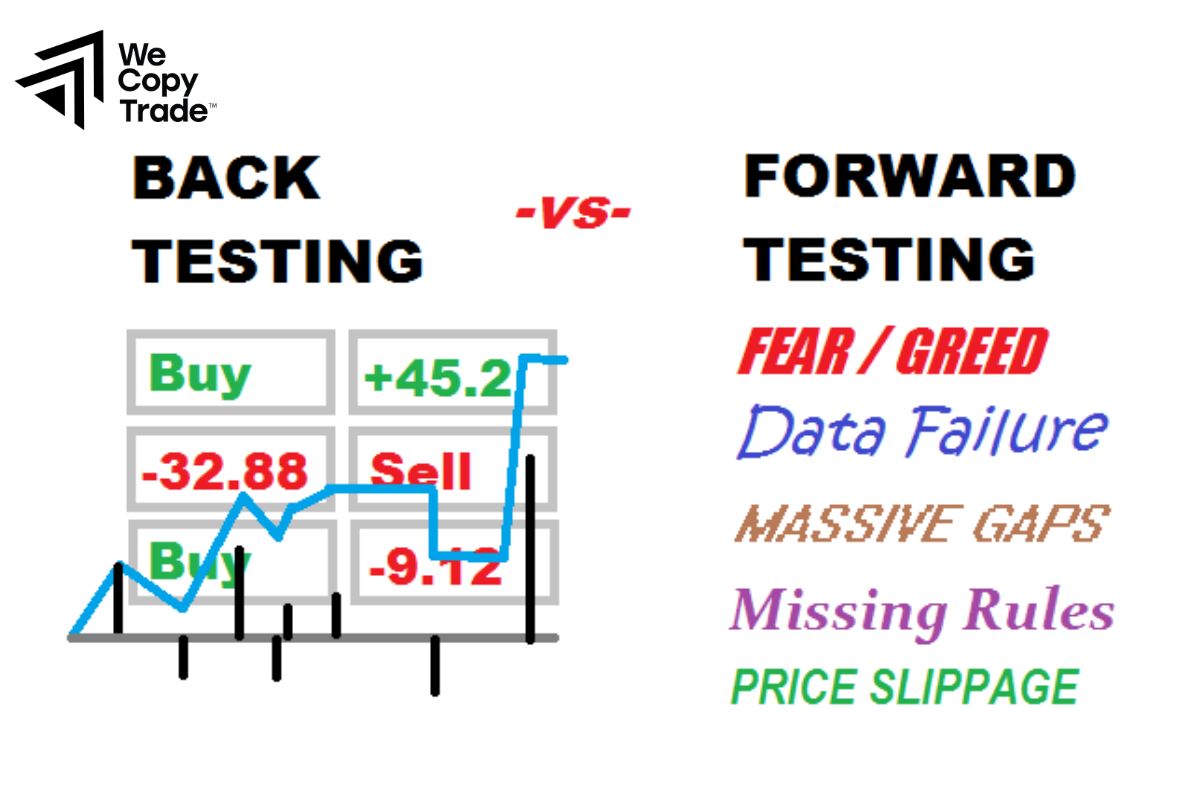

Backtesting vs Forward Performance Testing

- Forward performance testing and backtesting are two complementary tools in investing.

- Backtesting: Looking back to the past to evaluate the performance of a strategy.

- Forward performance testing: Looking forward by applying the strategy to real markets (although not actually trading).

- Both approaches have value, but forward performance testing gives us a better understanding of how the strategy performs in current market conditions.

How to Backtest on MetaTrader 4 (MT4)

Strategy Tester is a powerful tool built how to backtest on MT4 software, allowing traders to test and evaluate the performance of automated trading programs (Expert Advisors – EAs) before applying them to the real market.

Step 1: Prepare the EA

- Install the EA: Make sure that the EA you want to test is installed in the MQL4\Experts folder of MT4.

- Check the source code: If you have knowledge of MQL4, double-check the source code of the EA to make sure there are no syntax or logic errors.

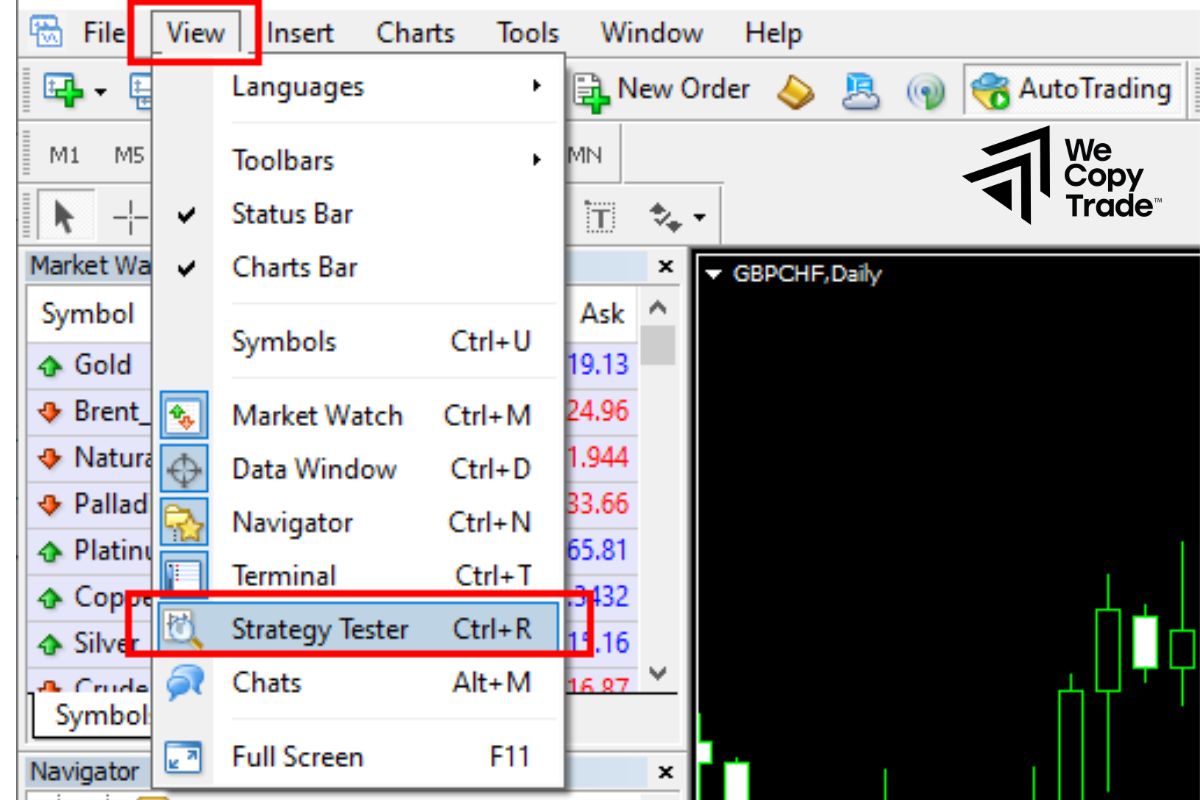

Step 2: Launch the Strategy Tester

- Open the chart of the currency pair or financial instrument you want to test the EA for.

- Go to the View menu -> Strategy Tester.

Step 3: Configure the test

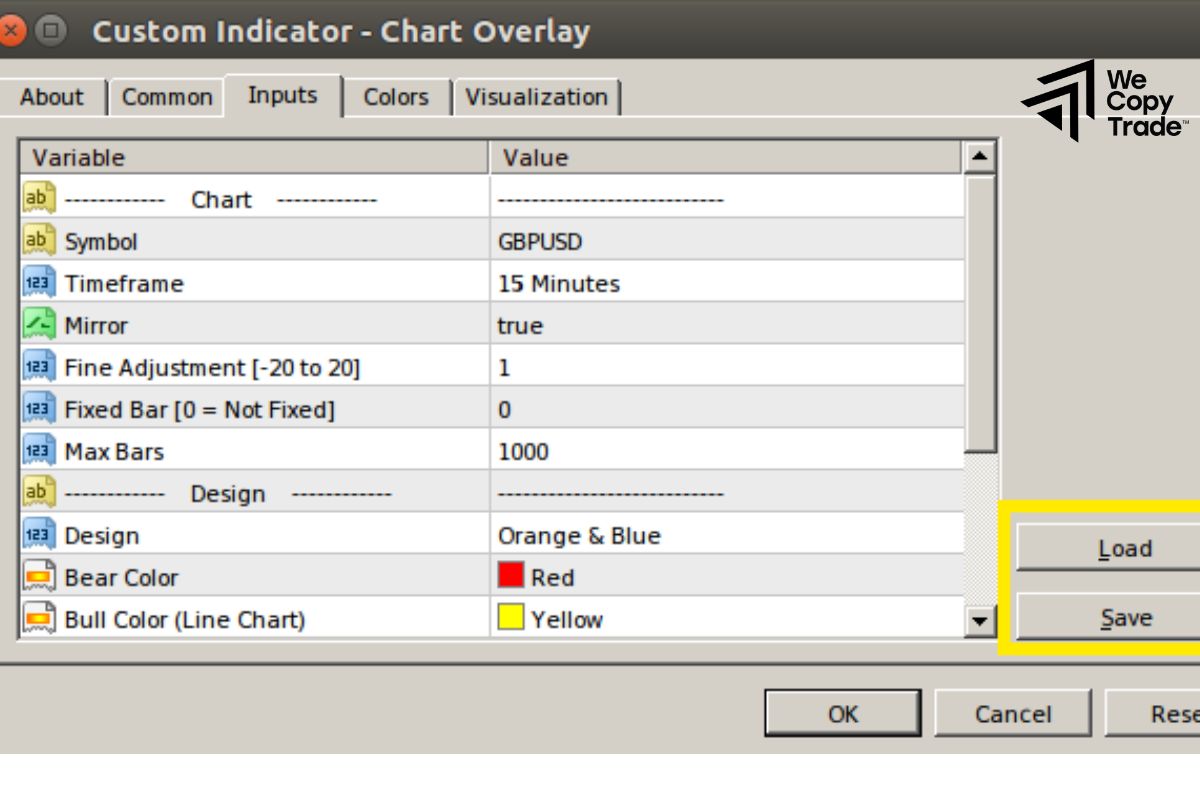

In the Strategy Tester window, select the EA you want to test from the list.

Set the parameters:

- Symbol: Select the currency pair or financial instrument.

- Timeframe: Select the time frame (M1, M5, M15, …).

- Model: Select the testing model (Open price, Close price, …).

- Optimization: If you want to optimize the parameters of the EA, select this option.

- Date: Set the testing period (from day to day).

- Visual mode: Select the display mode of the results (chart, report).

- Other parameters: Customize the input parameters of the EA if needed.

Step 4: Execute the test

- Click the “Start” button to start the testing process.

- Observe the testing process on the chart and the results table.

Step 5: Analyze the results

Observe the chart to evaluate the performance of the EA in terms of price, trading orders.

Read the report carefully to see important indicators such as:

- Net Profit

- Gross Profit

- Gross Loss

- Profit Factor: Profit/loss ratio.

- Max Drawdown: Maximum risk.

- Number of trades.

- % Profitable: Winning trade rate.

- Optimization: If necessary, adjust the parameters of the EA and repeat the testing process to find the best results.

Conclusion

In conclusion, you already know how to backtest on MT4, right? Don’t hesitate any longer, let’s start applying this tool right away to make accurate trading decisions. But don’t forget the limitations of the backtest tool I mentioned above to avoid making mistakes.

See now: