The Forex market is like a big casino where everyone wants to win. To increase your chances of winning and minimize your risk of losing, you need to have a good money management strategy. Managing Risk on MT4 system will help you clearly define the amount of money you can risk in each trade, helping you protect your account. Learn them right away!

Understanding Managing Risk on MT4

The Managing Risk on MT4 system works on the old adage “Never put all your eggs in one basket”?. Risk management is how you protect your account from unexpected market fluctuations. Simply put, risk management is identifying, assessing and controlling the risks that may occur when you enter a trade. The ultimate goal is to minimize losses if the trade does not go as expected.

See now:

- Customizing MT4 Charts easily in 5 minutes most detailed

- All Truths About MetaTrader 4 – Is MT4 safe to use

- Detailed instructions on how to install MT4 just 3 minutes

Why is risk management important?

- Helps you protect your capital, not losing all the money you have invested.

- When you have a clear risk management plan, you will feel more confident and less stressed when trading.

- Effective risk management is the foundation for a successful trading strategy.

Risk management tools on MT4

Managing Risk on MT4 is an extremely important factor in trading. Here are some of the components that make up an effective risk management system:

- Adjust the number of buy/sell orders to suit your account. This helps avoid the risk of losing too much money in a single trade.

- Compare the money you can make and the money you can lose before deciding to trade. The goal is to find trades where the potential for profit is much higher than the potential for loss.

- Hedge your risk to protect your assets when the market is volatile. Specifically, diversification is a popular way to hedge your risk. Instead of investing in just one type of asset, such as stocks, you can invest in many different types of assets, such as gold, real estate, or bonds. This is like not putting all your eggs in one basket. If one basket goes bust, you still have other baskets.

- A take profit order lets you pre-determine the price at which you want to sell a stock to secure a profit.

- A stop loss order is a tool that automatically sells a stock or other asset when the price drops to a certain level. This allows you to protect your investment by setting a limit on how much you’re willing to lose.

What does MT4 provide to support you in managing risk?

- The MT4 platform is equipped with many useful tools and features to help you manage risk effectively, such as:

- In addition to stop loss and take profit orders, MT4 also provides other types of orders such as trailing stop orders, partial position closing orders, etc.

- Many technical indicators can help you evaluate the risk of a trade.

- MT4 offers a user-friendly interface that makes it easy to monitor and manage your positions.

Using The MetaTrader4 Risk Management System Effectively

Forex trading is a psychological type of trading but there are many risks if we do not know how to manage them. To make the most of the effectiveness of the Managing Risk on MT4 system, you can do the following:

- Avoid unnecessary risks: if you do not have enough information, wait until you have more information before making a decision.

- Take partial profits: take a portion of profits out of the market when the price increases to protect the profits that have been made.

- Avoid break-even stops: do not change your stop loss to break-even too early. This gives you the opportunity to achieve higher profits

- Manage withdrawals: monitor and evaluate the performance of your trading so that you can improve in the future.

Calculate risk-reward with Fibonacci in MT4

The Fibonacci tool in MetaTrader 4 not only helps us identify potential support and resistance zones, but can also be used to manage risk in trading. By customizing the Fibonacci levels, we can set up an effective Managing Risk on MT4 system.

Steps:

Select the market you’re interested in analyzing

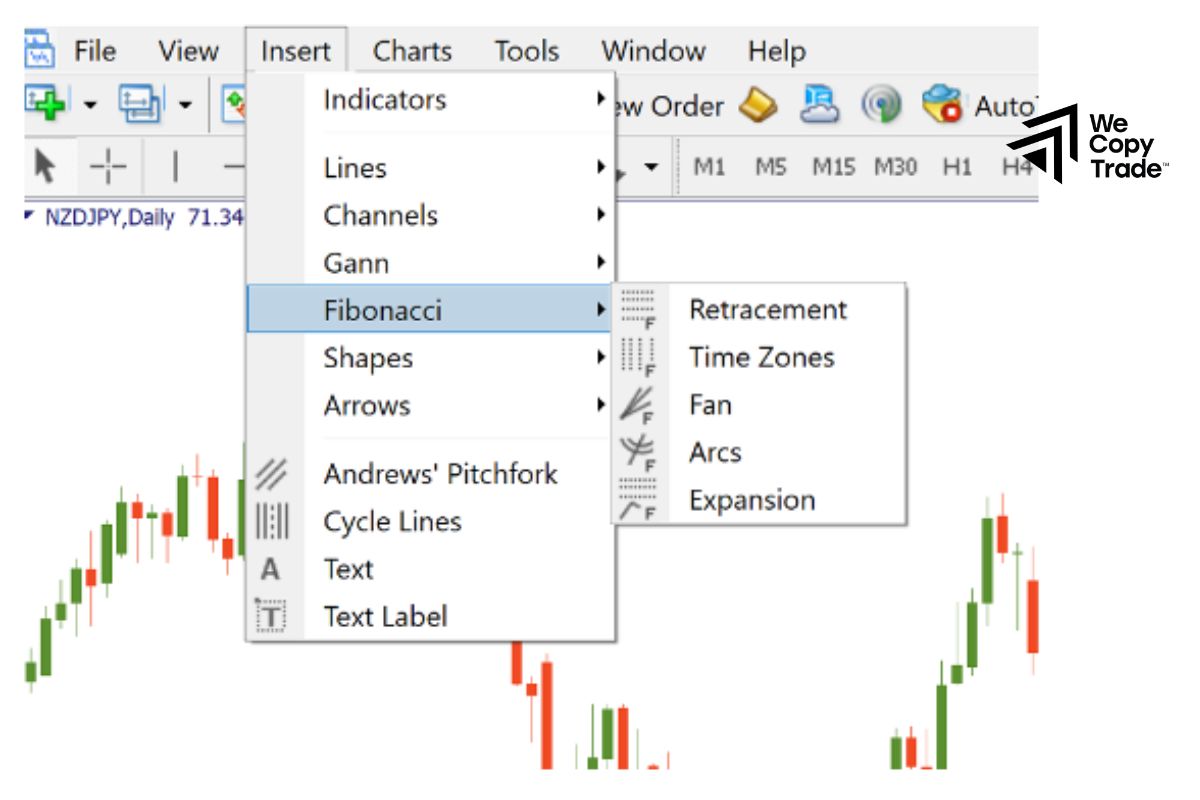

Select the Fibonacci tool:

- Go to the “Insert” menu.

- Select “Fibonacci” and then select “Retracement”.

Drawing Fibonacci lines:

- For a long position: Click on the lowest point of a price wave and drag up to the highest point to draw the Fibonacci line.

- For a short position: Click on the highest point of a price wave and drag down to the lowest point.

Adjusting Fibonacci levels for risk-reward ratios:

- Instead of using the default Fibonacci levels (23.6%, 38.2%, 61.8%, etc.), we will replace them with levels that match the risk/reward ratio you want to achieve.

For example, if you want to risk $1 to make $2, you can set 0% at your entry point, -100% at your stop loss (risk), and 200% at your take profit (profit).

Conclusion

In conclusion, is the Managing Risk on MT4 really useful? After today’s article, designing yourself an effective strategy and taking advantage of this toolkit to optimize profits and minimize risks immediately!

See more: