Unlock the potential of your trading strategy with MT4 automated trading systems! These powerful tools allow you to execute trades automatically based on predefined rules, freeing you from the stress of constant market monitoring. So, don’t miss out on lucrative opportunities, start exploring MT4 automated trading systems today and elevate your trading game!

What are the MT4 automated trading systems?

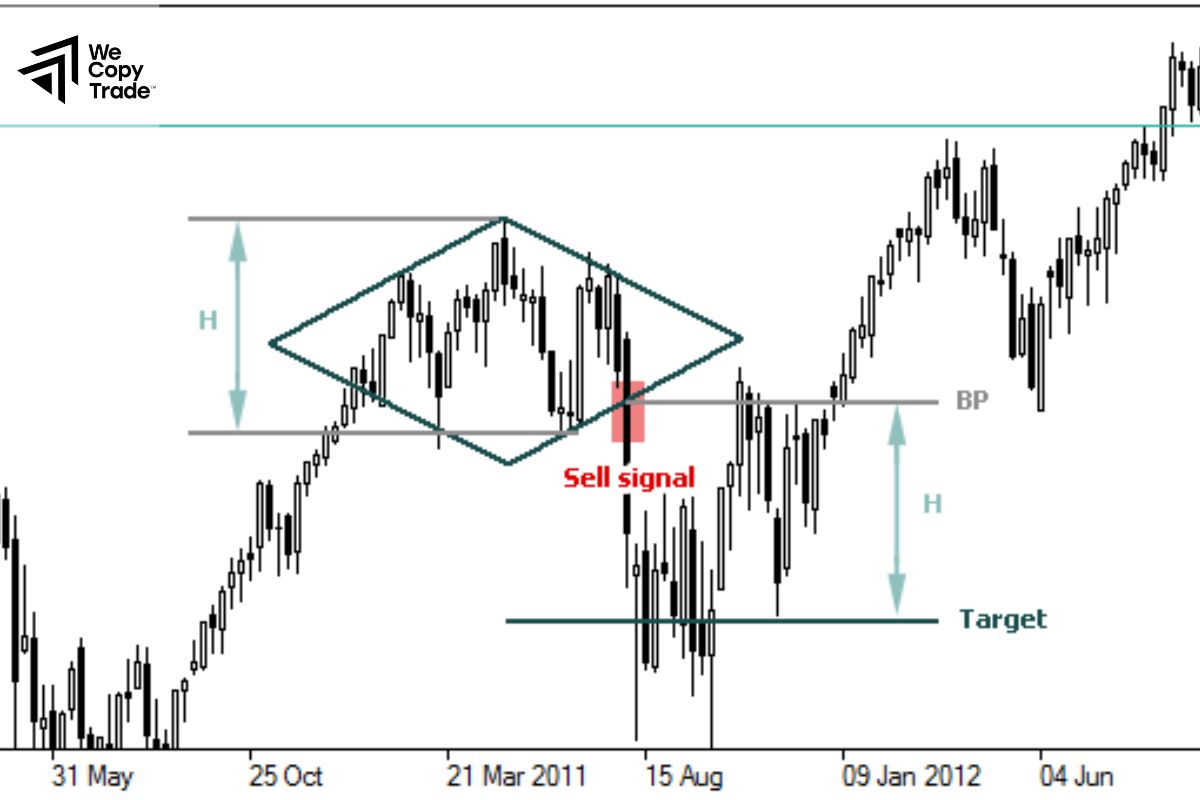

MT4 automated trading systems are a popular platform for trading forex and other financial instruments, known for its automated trading capabilities through Expert Advisors (EAs). EAs are automated scripts that execute trades based on predefined criteria. There are various types of automated trading systems, including trend-following EAs, scalping, arbitrage, grid trading, and news trading.

Besides, MT4 offers features like backtesting and optimization to improve trading performance. While automated trading helps eliminate emotional factors and allows for 24/5 trading, it also carries risks such as technical failures and unexpected market changes. To get started, users need to download MT4, access the MQL4 editor to create or modify EAs, and use the strategy testing tool to optimize performance before deploying it on a live account.

See now:

- MT4 Account Types – Which is Better for Forex Trading?

- MT4 For Mobile Trading Platform – How to Download MT4

- Step-by-step Guide using MT4 Demo Account Guide In 5 Minutes

How to Use the Best MT4 Automated Trading System

Using the best MT4 automated trading systems effectively involves several key steps. Here’s a concise guide to help you maximize your trading success:

Pick the Right Expert Advisor (EA)

- Look for EAs that come highly recommended and fit your trading style, whether you prefer trend-following or scalping.

- Test your chosen EA on a demo account first to see how it performs without any risk.

Get MT4 and Set Up the EA

- Grab the MetaTrader 4 platform from your broker. It’s user-friendly and easy to install.

- Simply place the EA files in the “Experts” folder within your MT4 installation—it’s that easy!

Tweak Your EA Settings

- Adjust settings like risk levels, stop-loss, and take-profit according to your preferences.

- Use the strategy tester to find the best settings for different market situations.

Backtest the EA

- Run the EA on past data to see how it would have performed. It’s like a practice round!

- Look at the win rates and overall profitability to gauge how effective the EA.

Take the Leap with a Live Account

- Begin using the EA on a small live account to see how it handles real trades.

- Regularly monitor its performance and make adjustments as needed.

Best MT4 Forex Automated Trading Systems

Here are some of the best MT4 automated trading systems that have gained popularity among traders due to their performance, reliability, and user-friendly features:

Forex Fury

Known for its high win rates and low drawdowns, Forex Fury is designed for both novice and experienced traders.

- Works with multiple currency pairs

- Supports both scalping and longer-term strategies

- Regular updates and a money-back guarantee

GPS Forex Robot

This EA uses advanced algorithms to identify market trends and execute trades.

- Claims to have a high success rate

- Simple installation and user-friendly interface

- Offers real-time trade tracking and performance reports

EA Builder

A unique tool that allows you to create your own custom EAs without programming knowledge.

- Drag-and-drop interface for easy customization

- Backtesting capabilities

- Option to include multiple strategies in one EA

Forex Diamond

This EA employs a combination of trend-following, counter-trend, and breakout strategies.

- Automatic adjustment of lot sizes based on market conditions

- Built-in risk management tools

- Compatible with various currency pairs

Night Owl

Night Owl specializes in trading during low-volatility hours, primarily at night.

- Suitable for traders looking for less competition in the market

- User-friendly setup and management

- Focuses on a specific set of currency pairs for better performance

WallStreet Forex Robot

This EA is designed to operate in all market conditions and is particularly good at capitalizing on small price movements.

- Adaptive trading strategies that adjust to market conditions

- High level of automation with minimal user intervention

- Includes a built-in news filter to avoid trading during high-impact news events

Odin Forex Robot

Odin is an advanced EA that uses a grid trading strategy and has gained a reputation for profitability.

- Offers full automation with customizable risk settings

- Comprehensive backtesting options

- Can be used on various currency pairs and timeframes

Advantages of Using Automated Trading Systems

Here’s a concise overview of the advantages of using MT4 automated trading systems:

- Emotional Control: EAs operate based on algorithms, eliminating emotional decision-making and promoting discipline.

- 24/5 Trading: Automated systems can monitor and trade the market around the clock, capturing opportunities even when you’re away.

- Consistency: They follow predefined strategies consistently, ensuring disciplined execution without deviation.

- Speed: EAs execute trades in milliseconds, which is crucial in fast-moving markets.

- Backtesting: Traders can evaluate strategies using historical data to see potential past performance before going live.

- Diversification: Automated systems can manage multiple accounts and trade various instruments simultaneously, enhancing portfolio diversification.

- Customizable Strategies: Many EAs allow customization to fit individual risk tolerance and trading styles.

- Time Savings: Automation reduces the need for constant monitoring, freeing up time for strategy development.

Mistakes About Automated Trading Systems

Here are some common mistakes people make regarding MT4 automated trading systems:

Over Reliance on Automation

Many traders think that automated systems will guarantee profits without any oversight. It’s essential to understand that they still require monitoring and regular adjustments.

Neglecting Backtesting

Skipping backtesting can lead to using an EA that hasn’t proven its effectiveness. Traders should always test strategies on historical data before deploying them in live markets.

Ignoring Market Conditions

Automated systems may perform well under certain market conditions but poorly under others. Failing to adapt or adjust settings for changing market dynamics can lead to losses.

Setting Unrealistic Expectations

Expecting quick profits or consistent high returns can lead to disappointment. Automated systems can enhance trading efficiency but should not be viewed as a “get-rich-quick” solution.

FAQs About the Best MT4 Forex Automated Trading Systems

Here are some frequently asked questions (FAQs) about the best MT4 automated trading systems:

Can I customize an automated trading system?

- Yes, many EAs come with customizable parameters that allow you to adjust settings like risk levels, stop-loss, and take-profit according to your trading preferences.

Is backtesting necessary?

- Absolutely! Backtesting allows you to evaluate how an EA would have performed using historical data. This helps identify its effectiveness before deploying it in a live trading environment.

Can automated trading systems guarantee profits?

- No, there are no guarantees in trading. While automated systems can enhance trading efficiency and remove emotional biases, they still carry risks and depend on market conditions.

Conclusion

In conclusion, MT4 automated trading systems offer a powerful solution for traders looking to enhance their trading efficiency and capitalize on market opportunities. However, it’s crucial to conduct thorough research, backtest strategies, and apply proper risk management to maximize your success. Explore the best MT4 automated trading systems today and start your journey toward more efficient and profitable trading!

See more: