When trading in the Forex market, understanding the concept of “pip” is crucial for any investor. Whether you are a beginner or an experienced trader, mastering the calculation and significance of pips can greatly impact your trading strategies and outcomes. So, this guide will walk you through everything you need to know about pips ensuring you have the knowledge to make informed decisions in the Forex market.

Definition & Meaning of Pip in Forex

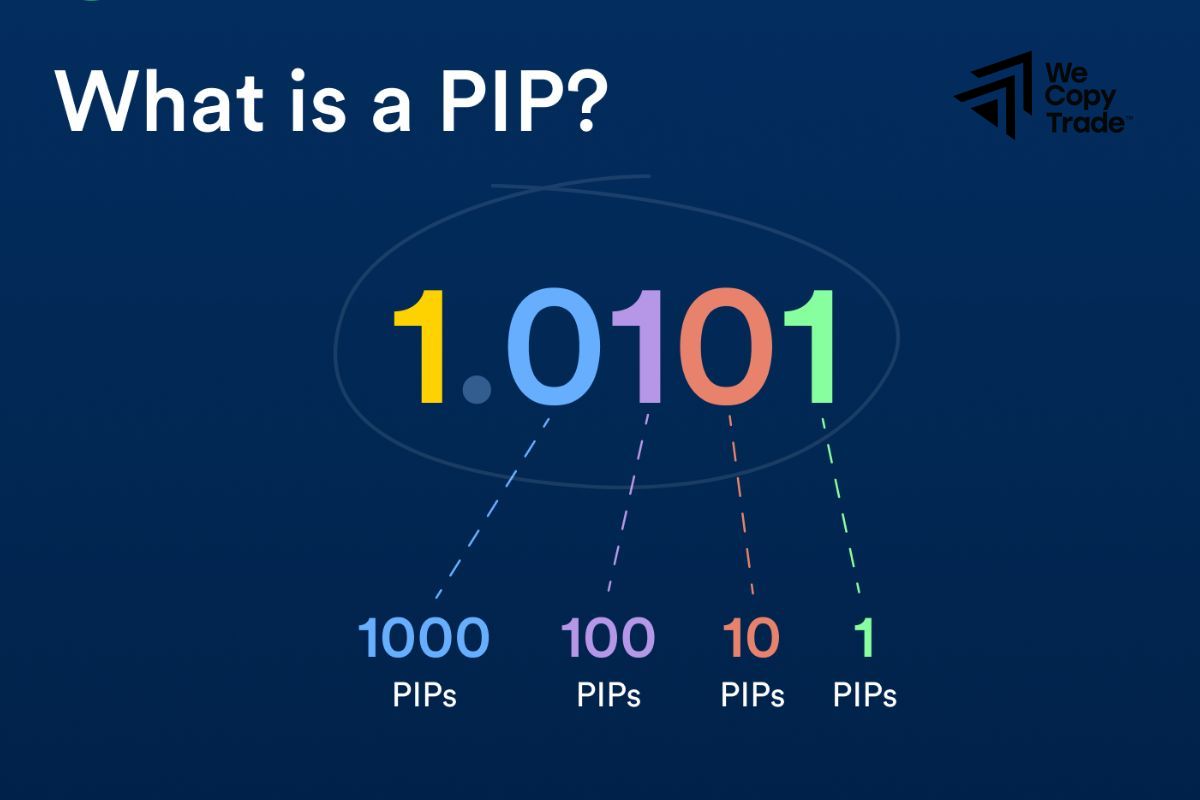

In Forex trading, a pip (short for “percentage in point” or “price interest point”) is a standard unit of measurement for the smallest possible price movement in a currency pair. For most currency pairs, one pip is equal to 0.0001, which means a change in the fourth decimal place (e.g., from 1.2345 to 1.2346).

Besides, Pips are essential for calculating profits and losses, as they help traders quantify how much a currency pair’s price has moved. By understanding pips, traders can assess price fluctuations and make informed decisions in their trading strategies.

See now:

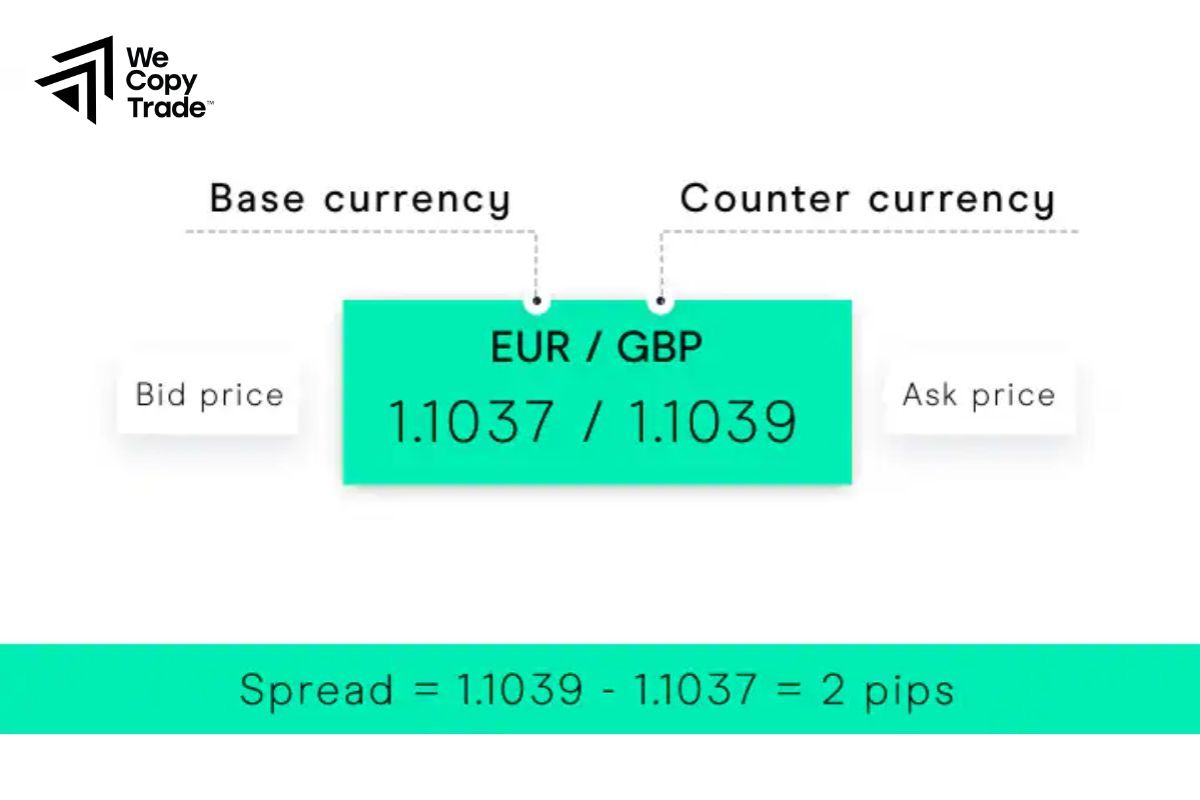

- What is Forex Spread? What are the Impacts and Types of Forex Spread?

- What is Margin? The best margin stock calculation formula

How to Calculate Pip and Lot in Forex with a Pip Calculator

Calculating pips and lots in Forex is essential for understanding your potential gains or losses. A pip represents the smallest price movement in a currency pair, typically 0.0001 for most pairs. A lot is the standard unit size of a Forex transaction, with a standard lot equaling 100,000 units of the base currency.

How to Calculate Pips

To calculate the pip value for a currency pair:

- Determine the number of pips: Subtract the starting price from the ending price of the currency pair.

- Example: If EUR/USD moves from 1.2345 to 1.2355, the difference is 10 pips.

- Calculate Pip Value: Use the formula:

- Pip Value = (One Pip / Exchange Rate) × Lot Size

- For a standard lot of 100,000 units: Pip Value = (0.0001 / 1.2355) × 100,000 ≈ $8.10

How to Calculate Lot Size

To determine the appropriate lot size:

- Choose your risk level: Decide how much you’re willing to risk per trade.

- Example: You decide to risk $100.

- Determine Pip Value per lot size: Use the pip value calculation to see how much each pip movement will affect your trade.

- Example: If Pip Value is $8.10, risking $100 means your lot size should be calculated based on how many pips you expect the price to move.

How to Calculate the Number of Pips in Forex for Major Currency Pairs

Calculating the number of pips in Forex for major currency pairs is straightforward once you understand how pips work. Here’s a step-by-step guide:

Understand the Pip Definition

- Pip stands for “percentage in point” or “price interest point,” and it represents the smallest price movement in a currency pair.

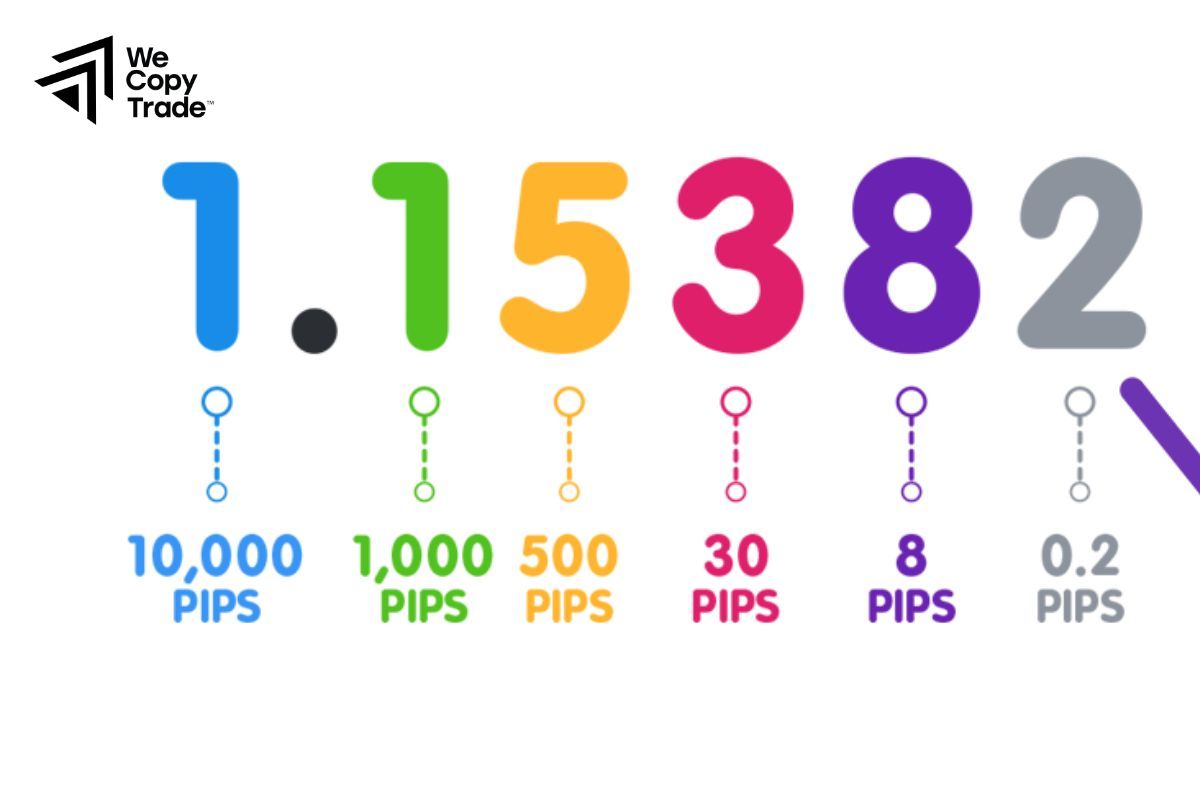

- For most currency pairs, a pip is 0.0001, but for pairs involving the Japanese Yen (JPY), a pip is 0.01.

Determine the Price Movement

To calculate the number of pip, you need to know the starting and ending prices of the currency pair.

- Example 1: For EUR/USD, if the price moves from 1.2345 to 1.2360:

- Number of Pips = Ending Price – Starting Price

- Number of Pips = 1.2360 – 1.2345 = 0.0015

- Since a pip is 0.0001, you convert this movement into pips: 0.0015 / 0.0001 = 15 pips

- Example 2: For USD/JPY, if the price moves from 110.50 to 110.75:

- Number of Pips = Ending Price – Starting Price

- Number of Pips = 110.75 – 110.50 = 0.25

- Since a pip is 0.01 for JPY pairs: 0.25 / 0.01 = 25 pips

Practical Steps

- Identify the Currency Pair: Recognize if it’s a major pair with 0.0001 pips or a JPY pair with 0.01 pips.

- Record the Prices: Note the opening and closing prices for the calculation.

- Calculate the Pip Movement:

- Subtract the starting price from the ending price.

- Convert the result into pips based on the decimal place (0.0001 for most pairs or 0.01 for JPY pairs).

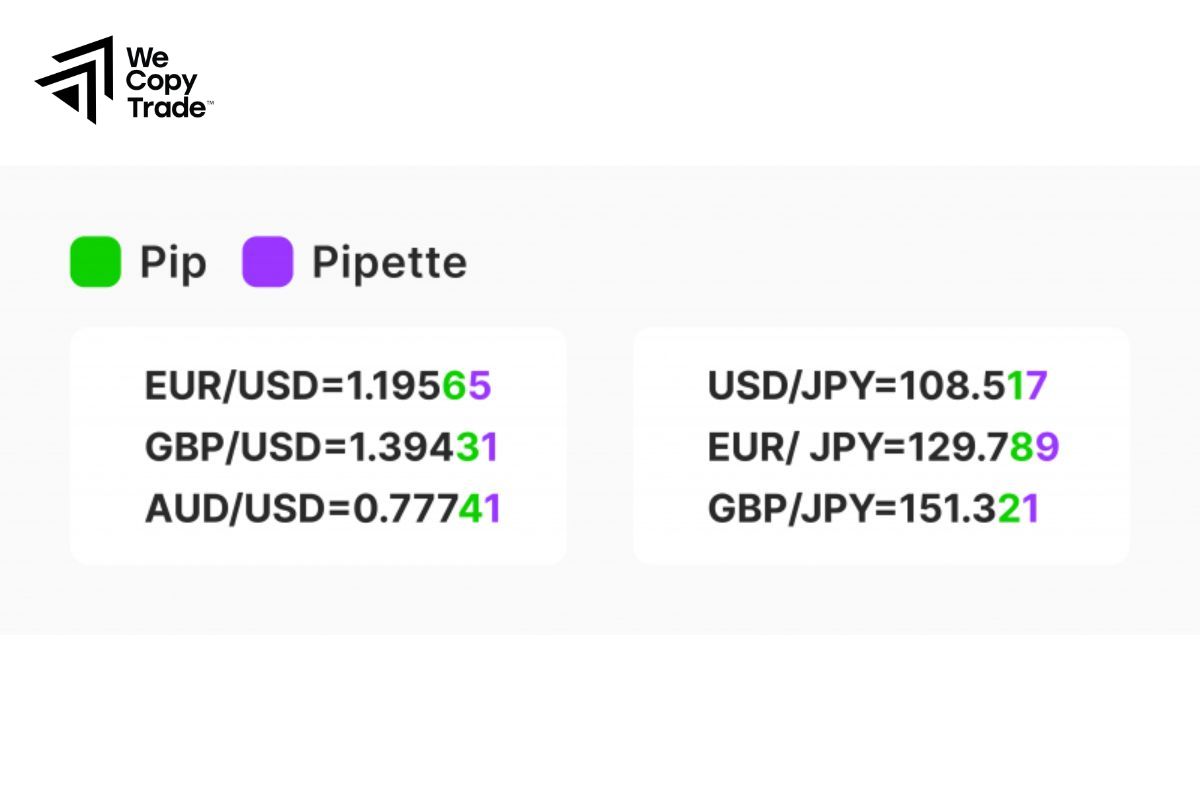

What Is the Difference Between a Pip and a Pipette?

Here is the table comparing pip and pipette in Forex trading:

| Criteria | Pip | Pipette |

| Definition | The smallest price movement, representing a change in the fourth decimal place (0.0001) for most currency pairs. | A smaller price movement, representing a change in the fifth decimal place (0.00001) for most currency pairs. |

| JPY Pairs | For pairs involving JPY, a pip represents a change in the second decimal place (0.01). | For pairs involving JPY, a pipette represents a change in the third decimal place (0.001). |

| Value and Precision | Used to measure larger price movements, commonly used in trade analysis and profit/loss calculations. | Provides finer precision, suitable for detailed analysis and high-frequency trading. |

| Application in Trading | Commonly used in standard trade analysis and calculating trade outcomes. For example, a 10-pip movement in EUR/USD might represent a $100 gain or loss in a standard lot. | Suitable for trading strategies requiring high precision, such as high-frequency trading or in volatile market conditions. |

| Impact on Trading | Provides a standardized measure for price movements and trade results. Useful for general analysis and risk management. | Allows for detailed measurement and higher precision in price movements. Beneficial for traders needing detailed precision and accurate trading strategies. |

Conclusion

In conclusion, understanding Pip is essential to mastering Forex trading. So start applying this knowledge today and enhance your trading skills to achieve your financial goals. For more tips and strategies, explore our resources and join our trading community!

See more: