Prop firms have become an attractive option for skilled traders who lack capital. This model not only provides access to substantial funds but also opens a path toward financial freedom without requiring an initial investment of thousands of dollars. However, behind the glamor of advertisements and tempting offers lies a side not everyone is fully aware of. The prop firm financial mystery does not reside in the model itself, but in how rules are implemented, the reality of trading conditions, and the expectations set forth.

This article will help you decode these mysteries clearly and fairly, so you can understand, choose, and act wisely when stepping into the world of prop trading.

See more:

- Some Prop Firm Trading Loopholes Traders Need to Know

- Discover Prop Firm Services – Interesting Facts to Remember

- Building The Path to Prop Firm Success for Traders

Understand Prop Firms Properly

A prop firm (proprietary trading firm) is a capital funding model for traders, allowing you to trade with the company’s money instead of your own. In return, you must pass a series of evaluations that test your skills, risk management, and ability to follow trading discipline.

This is not a barrier — it is a process designed to train traders to think professionally, control emotions, and act like a true trader.

The prop firm financial mystery starts here:

Many traders don’t fail because of the market — they fail due to a lack of discipline, poor emotional control, and unwillingness to take long-term responsibility for each trade.

Ask yourself:

-

Can you maintain composure after a winning — or losing — streak?

-

Can you strictly follow the required risk limits?

-

Can you trade consistently for 30 straight days without violating any rules?

If yes, then a prop firm is the right place to build your career. Understanding the prop firm financial mystery from the start will help you avoid common mistakes many new traders make.

Prop Firm Financial Mystery Traders Must Know

Most traders fail because they are “too lazy to research” about prop firms before joining, often overwhelmed by too many sources. Don’t worry — WeMasterTrade has distilled the most accurate and concise insights into the prop firm financial mystery below:

High Profit Split – But Not for Everyone

You’ll often see prop firms advertising profit splits of up to 90% — an extremely appealing figure. However, what’s rarely mentioned is that to withdraw profits, you need to:

-

Meet a consistency ratio (your highest profit day should not exceed 15–25% of total profits).

-

Avoid violating news trading rules.

-

Complete a minimum number of valid trading days (usually 3–5 real trading days).

Many traders pass the challenge but are blocked at the withdrawal stage for not meeting the payout criteria. So don’t just look at the profit split numbers — read the attached conditions carefully.

Hidden Rules That Can Get Your Account Banned

One of the key prop firm financial mysteries that many traders — especially beginners — don’t foresee is losing an account not because of losing trades, but because of rules they didn’t know existed.

In reality, many important terms are buried deep in the Program Rules section, or silently updated without clear notifications. If you don’t actively read them, you could break a rule without even realizing it.

Common examples:

-

Using automated software (EAs) or copying trades from other accounts without permission is usually prohibited.

-

Martingale strategies or ultra-fast trading (under 60 seconds) may be flagged as high-risk and violate rules.

-

If you don’t open a trade for 30 consecutive days, even after becoming funded, your account may still be closed.

These may seem minor, but they are strict rules prop firms use to maintain system discipline. And if you don’t understand them, even with good trades, you could still be disqualified.

If you’re truly serious about this model:

-

Read every line in the “Program Rules” section before joining.

-

Regularly check for policy updates via email or website.

-

Ask support if anything is unclear — never assume.

The prop firm financial mystery lies not in complicated terms — but in those small details that directly impact your outcome and rights.

Understanding the rules is the first step to playing the game right — and winning in the long run.

Not All Prop Firms Want You to Succeed

This is a realistic, not negative, perspective:

Prop firms generally fall into two categories:

-

Firms that focus on developing long-term traders, sharing real profits, and enforcing strict risk management.

-

Firms that profit more from selling challenges than paying successful traders.

The prop firm financial mystery here is: some companies set extremely strict rules, or vague “soft breaches” that make it easy to lose your payout rights even if you meet the target.

Who’s Really Controlling Your Trading Data?

Modern prop firms use powerful tech platforms to:

-

Analyze trading behaviors.

-

Detect EAs, bots, or suspicious copy trade actions.

-

Evaluate risk by strategy.

This creates a fair environment, but the risk is being flagged if you unknowingly use disallowed tools.

So always check the approved list of software, bots, or EAs before starting. Avoid duplicating trades across multiple accounts unless you’ve confirmed it’s allowed. Choosing the right prop firm is vital to avoid falling into a prop firm financial mystery you don’t yet understand.

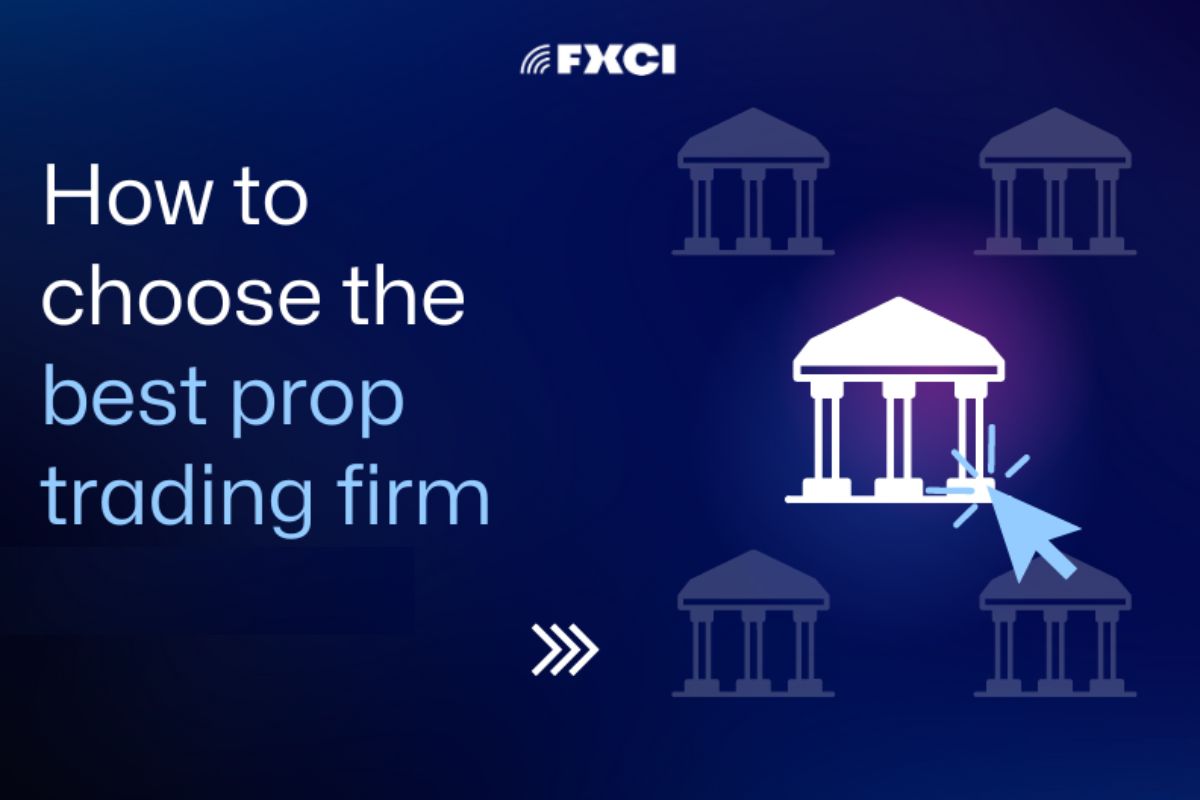

How to Choose the Right Prop Firm?

To avoid traps or false expectations, select your prop firm based on clear criteria:

| Criteria | Questions to Ask |

|---|---|

| Trading policies | Do they allow news trading or holding trades over the weekend? |

| Transparency | Do they clearly disclose their team, terms, and refund policy? |

| Community feedback | Are there real reviews on Reddit, Trustpilot, or Discord? |

| Fees & profit split | Do they match your current skill level? Any hidden fees? |

Conclusion

In short, the prop firm financial mystery doesn’t lie in ambiguity — it lies in the fact that many traders enter the game without understanding the rules. Once you truly understand and seriously follow a prop firm’s terms, you’ll see that it’s not a trap — but a real growth opportunity.