In the modern era of trading, gaining access to large trading capital from prop firms is becoming an increasingly popular trend. However, to achieve success, traders need to master the proper prop firm investment tips. The following article will provide detailed guidance, from selecting a prop firm to strategies for maintaining accounts and optimizing profits.

See more:

- Master Prop Firm Business Psychology – Master Trading

- Top Effective Prop Firm Trading Tools Traders Must Know

- Getting Started for Prop Firm Investors: A Beginner’s Guide

Why Invest Through a Prop Firm?

A prop firm offers the opportunity to trade with large capital without having to use personal funds. Traders only need to pass an evaluation process, comply with regulations, and share profits. This model helps traders scale up their trading, develop discipline, and avoid high financial risk.

The benefits of using funded capital

Not everyone has tens of thousands of USD ready to trade. The key to prop firm investment lies in using funded capital from companies to improve access to larger markets while keeping risk to a minimum.

Learning practical skills from a prop firm

The challenge and trading process at a prop firm trains traders in essential skills: capital management, emotional control, and deep analytical thinking. These are sustainable foundations for a long-term career.

Choosing a Prop Firm – The First Step in Prop Firm Investment Tips

Not all prop firms are the same. Choosing the right partner is the first thing in the prop firm investment tips.

Evaluating the assessment process and risk

Each firm will apply its own test, including profit target, maximum drawdown, daily loss limit, etc. Traders need to choose an evaluation model that fits their trading style and risk tolerance.

Transparency and support

A reputable firm will have a clear payout process, prompt support, and no hidden conditions when withdrawing funds. Effective prop firm investing begins with transparency and system support.

Tools and community

Firms that offer training, smart dashboards, or an active community provide a major advantage in helping traders maintain motivation and update strategies. Platforms with discussion forums, coaching, or learning resources tend to have higher success rates.

The Stages of Becoming a Funded Trader

The process of becoming a funded trader usually includes:

-

Challenge stage

-

Verification stage

-

Signing a contract and trading with real capital

Throughout the process, traders need to maintain discipline and meet profit and drawdown requirements. This is part of the prop firm investment tip: do not skip any small step.

Discipline defeats pressure

Trading with someone else’s money requires emotional control. Without psychological stability, traders can easily break rules and miss opportunities.

Tracking and evaluating trades

Effective prop firm investment tips include keeping a trading journal. This allows traders to identify winning/losing trade patterns to optimize strategies.

How to Pass the Challenge and Increase Success Rate

To pass the challenge process and achieve prop firm success more easily, successful traders always follow these core principles:

Stick to profit/drawdown rules

Even if the target is reached, traders can still fail by violating daily loss or total monthly drawdown rules. Prop firm investing is not just about making profits but also about maintaining strict discipline.

Create a trading plan before each week

Planning ahead helps traders stay proactive and avoid emotional decision-making. Every trade should have a clear direction on risk/reward ratio, trading hours, and reasonable price levels.

Choose a firm that fits your trading style

For scalpers: choose a firm that allows trading during news releases and does not delay execution. For swing traders: read the rules carefully about overnight holds and overnight fees.

After Getting Funded – Maintaining and Growing

This is the real test, where the trader’s strategy and mindset are tested in an environment with real psychological and risk factors.

Prioritize stability and capital preservation

Instead of focusing on “peak” profits, the prop firm investment tip at this stage is to maintain stable performance. This includes:

-

Closely monitoring drawdown to avoid breaching account limits

-

Setting daily and weekly auto stop-loss thresholds to control risk

-

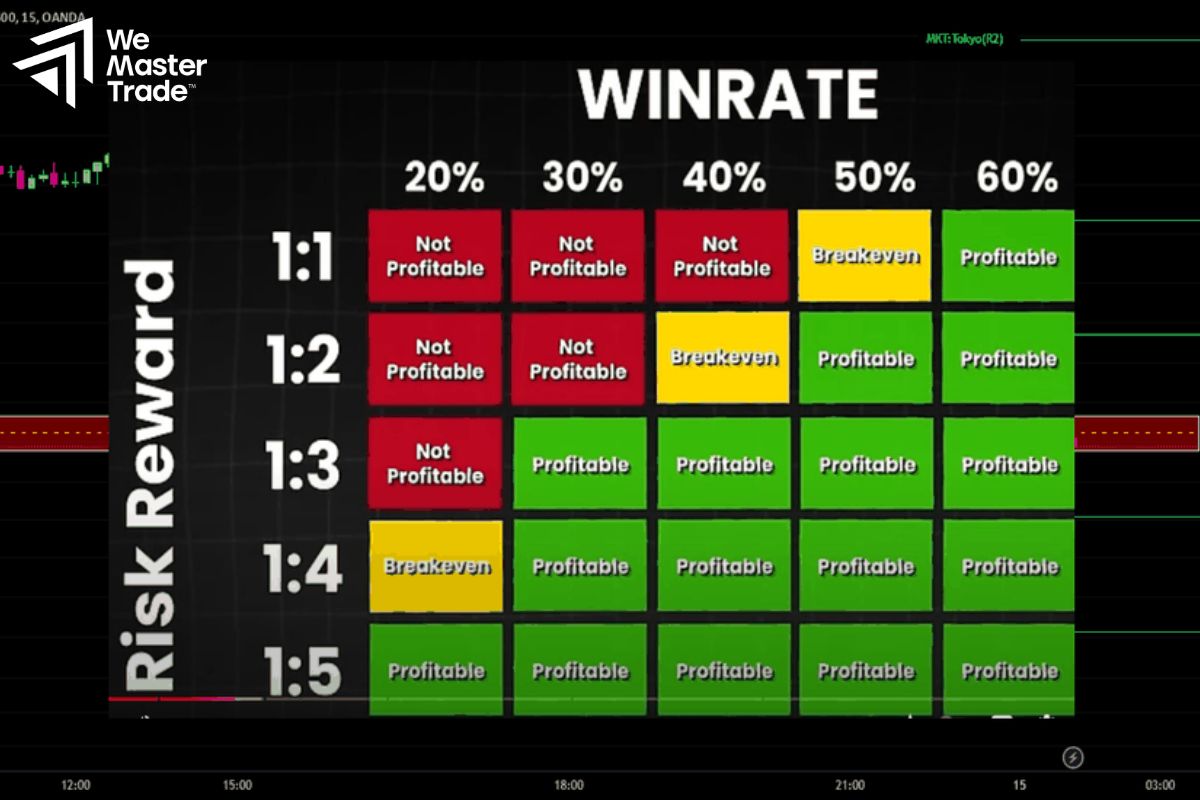

Maintaining a reasonable win rate and RR ratio to prolong account life

Payout is not simply withdrawing money

An important part of prop firm investing is understanding each company’s profit withdrawal policy. Clarify:

-

How many minimum trading days are required to get a payout?

-

What is the minimum profit required?

-

Are there identity verification requirements or an approval waiting process?

-

Is the payout calculated on balance or equity?

Only by knowing these can traders make accurate financial plans and not miss the reward for their trading efforts.

Connect with the community – stay motivated and learn

Many reputable prop firms now provide performance statistics systems, dashboards to track each trade’s results, and strategy-sharing communities. These tools improve skills and prevent trading in an “isolated environment” – a factor that often leads to stress and mistakes.

Build an evaluation cycle – adjust strategy periodically

Prop firm investment tip: It’s not just about compliance but also optimization—review performance every 20–30 days to improve trading results.

-

Analyze performance: win rate, profit factor, average RR

-

Identify the most effective trading times of the day

-

Eliminate low-probability or overly emotional trades

This helps the account not only survive but also grow sustainably, meeting the goals for scaling up or increasing profit split in the future.

Conclusion

In short, investing in a prop firm is not just a trading strategy but a system of risk management, discipline, psychology, and partnership. The effective prop firm investment tip is to truly understand the criteria, choose the right firm, and maintain trading performance – which will help traders accelerate their financial journey faster than ever.

See more: