Have you ever used the short selling strategy in prop firms? Are you confident you fully understand how it works? This is one of the most promising trading strategies for many traders. However, if it’s not properly understood, investors can easily misuse it and suffer serious consequences. Let’s explore this strategy more thoroughly in the article below.

What Is Short Selling in Prop Firms?

What is Short Selling in Prop Firms?

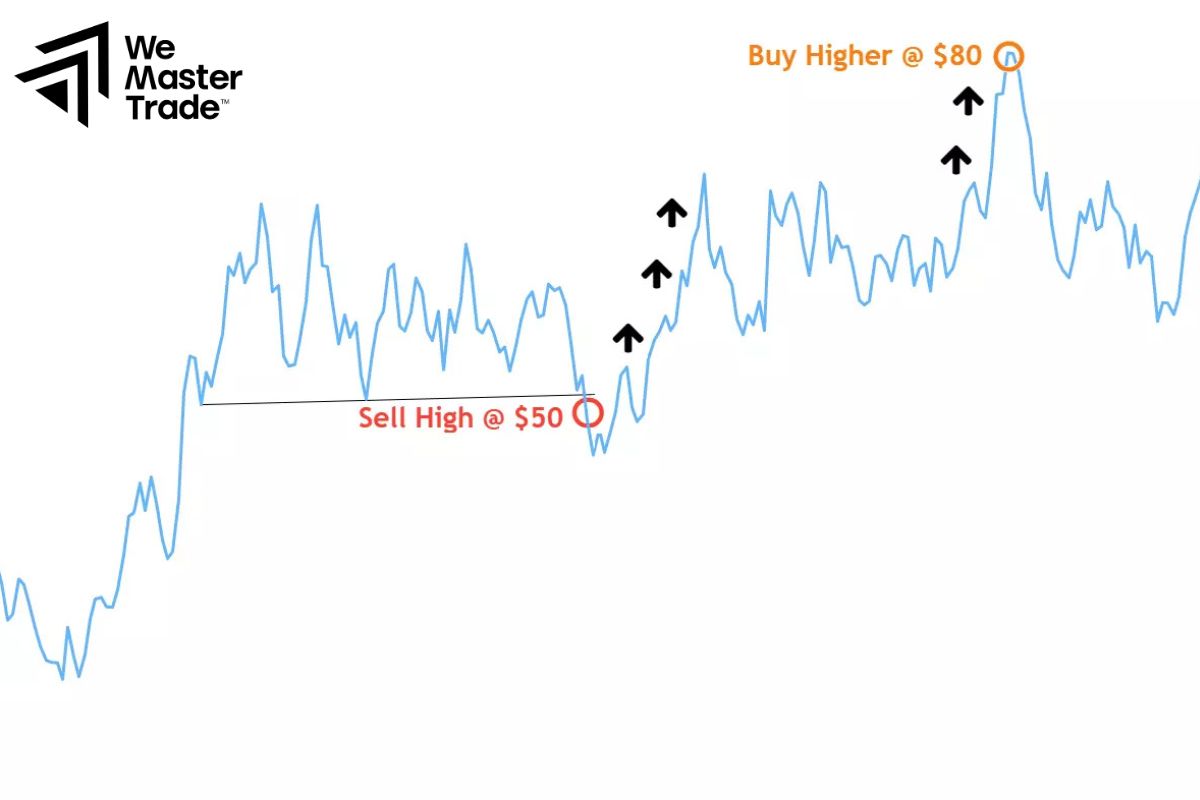

Short selling in prop firms is a strategy where traders profit when a stock’s price goes down. Instead of waiting for a stock to rise in value and selling it like in traditional investing, short sellers do the opposite: they sell first, then buy back later at a lower price to profit from the difference.

Typically, investors buy stocks with growth potential, then wait for the price to go up in order to buy low and sell high. But with short selling in prop firms, traders sell high first and then buy low.

See now:

The Short Selling Process in Prop Firms

When a trader believes a stock’s price will drop, they can take advantage of the opportunity by short selling. In practice, this may only require a few clicks on a trading platform—such as pressing the “Sell” button—but behind that simple action is a somewhat more complex automated process.

Here’s how the short selling process in prop firms works:

- Borrow shares from the exchange: When a trader initiates a short sale, the brokerage firm borrows the shares from an available source and lends them to the trader.

- Sell the borrowed shares on the market: The system then sells those shares either at the current market price (market order) or at a pre-set price (limit order).

The Short Selling Process in Prop Firms

- Wait for the price to drop: If the trader’s prediction is correct and the stock price falls, they can then buy back the shares at a lower price.

- Repurchase and return the shares: When the trader closes the position—either manually or via take-profit/stop-loss orders—the system automatically buys back the shares and returns them to the lender (the broker).

- Profit (or loss): The difference between the initial selling price and the repurchase price is the trader’s profit (if the price falls) or loss (if the price rises).

Benefits of Short Selling in Prop Firms

In a professional trading environment like a prop firm, short selling is an essential tool for traders. It not only helps generate profits during market downturns but also plays a key role in improving risk management and enhancing market transparency.

Here are the standout benefits of short selling in prop firms:

Reflects the true value of a stock

Reflects the true value of a stock

In prop firms, professional traders often use short selling to target overvalued stocks. This helps the market correct prices to more reasonable levels and reduces the risk of financial bubbles.

An effective risk management tool

When trading with a prop firm’s capital, risk control is a top priority. Short selling allows traders to protect their accounts from sharp market corrections by offsetting long positions.

Enhances liquidity and trading efficiency

Short selling increases buying and selling opportunities in the market. This is crucial for prop firms, where order execution speed and liquidity directly affect trader performance.

Early detection of financial bubbles

Prop firm traders usually possess deep analytical skills. Short selling enables them to issue early warnings about irrationally surging stocks, thereby helping both traders and the firm avoid significant losses.

Exposes financial fraud

Exposes financial fraud

In-depth research by short sellers sometimes uncovers fraudulent activities in the market, contributing to a more fair and transparent trading environment.

Challenges Surrounding Short Selling in Prop Firms

Despite its many benefits, such as improving trading efficiency and aiding in risk hedging, short selling in prop firms is not without controversy.

Market Volatility: Some people are concerned that short selling can cause significant market volatility, especially during sensitive periods. This could lead to instability and confusion among retail investors.

Stock Price Manipulation: There are opinions suggesting that some short sellers may exploit this strategy to manipulate stock prices, intentionally driving prices down for profit. This is one of the reasons short selling has been subject to criticism.

Challenges Surrounding Short Selling in Prop Firms

Ethics in Trading: One of the major controversies surrounding short selling is the ethics of profiting from a company’s decline or crisis. In particular, there are concerns that short sellers might deliberately spread negative information to pressure a stock’s price, causing harm to the affected company.

Strict Oversight: Due to these concerns, regulatory agencies closely monitor short selling activities in prop firms. When the market shows signs of excessive volatility, they may temporarily impose restrictions on short selling to maintain overall market stability.

How to Manage Risk When Short Selling

Short selling in a prop firm environment offers attractive profit potential, but it also carries significant risks if not managed properly. To limit losses and protect their accounts, traders need to proactively implement effective risk management measures:

- Thorough Analysis Before Trading: Before placing any short sell orders, ensure that you have carefully studied the financial health of the target company, monitored key economic indicators, and stayed up-to-date with news that could affect the stock’s price.

How to Manage Risk When Short Selling

- Portfolio Diversification: In prop firm trading, you should avoid allocating all your capital to short selling. A balanced allocation across different sectors and asset types helps minimize risk during market fluctuations. It’s advisable to limit the proportion of capital used for short selling to a small percentage to avoid heavy losses if the market moves against your expectations.

- Use Stop-Loss Orders: This is an extremely important tool for risk control when short selling in prop firms. A stop-loss order automatically closes your position when the stock price rises to a certain level, thereby limiting the maximum potential loss. This is especially useful in fast-paced and high-pressure trading environments like those in prop firms.

Conclusion

In summary, short selling in prop firms is a widely used strategy due to its potential benefits. However, as discussed in the article, it also comes with several significant drawbacks. Make sure you fully understand the short selling strategy in prop firms before deciding to apply it in your own trading.

See more: