When participating in the financial market, not only profit but also risk control plays a vital role. One of the important indicators that helps you evaluate the performance and safety of your account is the drawdown index. So what is the drawdown index? How is it calculated and why does it greatly affect your trading strategy? This article will help you understand and effectively apply this index to avoid unnecessary account crashes. Follow along!

What is the Drawdown Index?

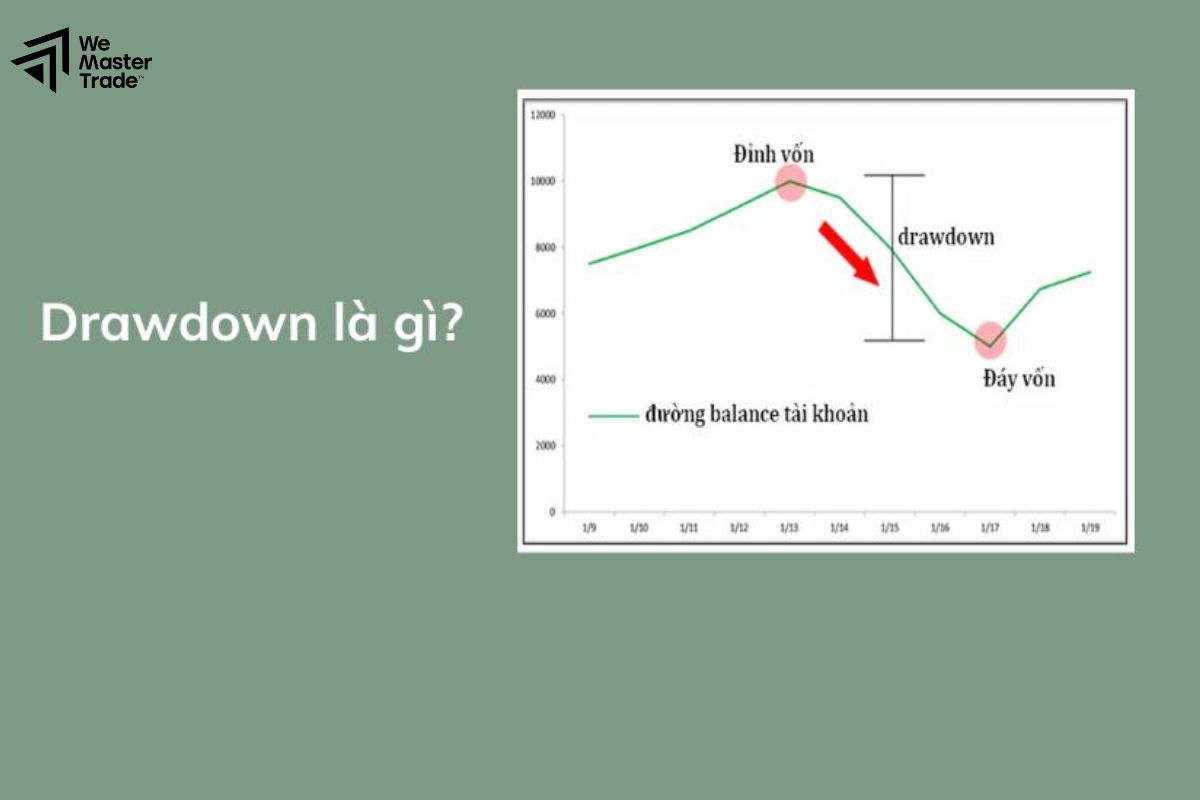

The drawdown index is a measure that shows the maximum capital loss of a trading account over a certain period of time, from the highest peak to the lowest trough before the account recovers. In other words, this index tells you how much of a “deepest loss” you have ever had during the trading process.

Some common types of drawdown indexes:

- Absolute Drawdown: The capital loss from the initial balance.

- Maximum Drawdown: The largest decline from peak to trough.

- Relative Drawdown: The percentage of decline relative to the current capital.

The drawdown index does not reflect the ability to make a profit, but it shows the level of risk you are or have faced. This is an extremely important index when evaluating the effectiveness of a trading strategy or comparing different investment systems.

See more:

- Master Prop Firm Business Psychology – Master Trading

- Top Effective Prop Firm Trading Tools Traders Must Know

- Getting Started for Prop Firm Investors: A Beginner’s Guide

- Prop Firm Career Opportunities: New Path for Traders

Why is Drawdown Index Important in Trading?

The drawdown index not only helps you review the deepest loss periods but also serves as a tool to measure the endurance of your account against market fluctuations. When the drawdown exceeds the allowable threshold, the ability to recover the account becomes more difficult.

For example, if you lose 50%, you need to gain 100% to return to the starting point. This is the reason why professional traders always closely monitor drawdown to set reasonable risk limits.

In addition, this index is also an important criterion to evaluate the quality of a trading system, especially when comparing multiple strategies or evaluating performance before joining a prop firm. Effectively controlling the drawdown index not only helps you protect your capital but also maintains confidence, discipline and psychological stability – factors that determine long-term success in trading.

How to calculate drawdown index you need to know

Understanding how to calculate drawdown index will help you be more proactive in monitoring and managing account risk. Below is a simple formula and application, suitable for both new and professional traders:

Drawdown Formula

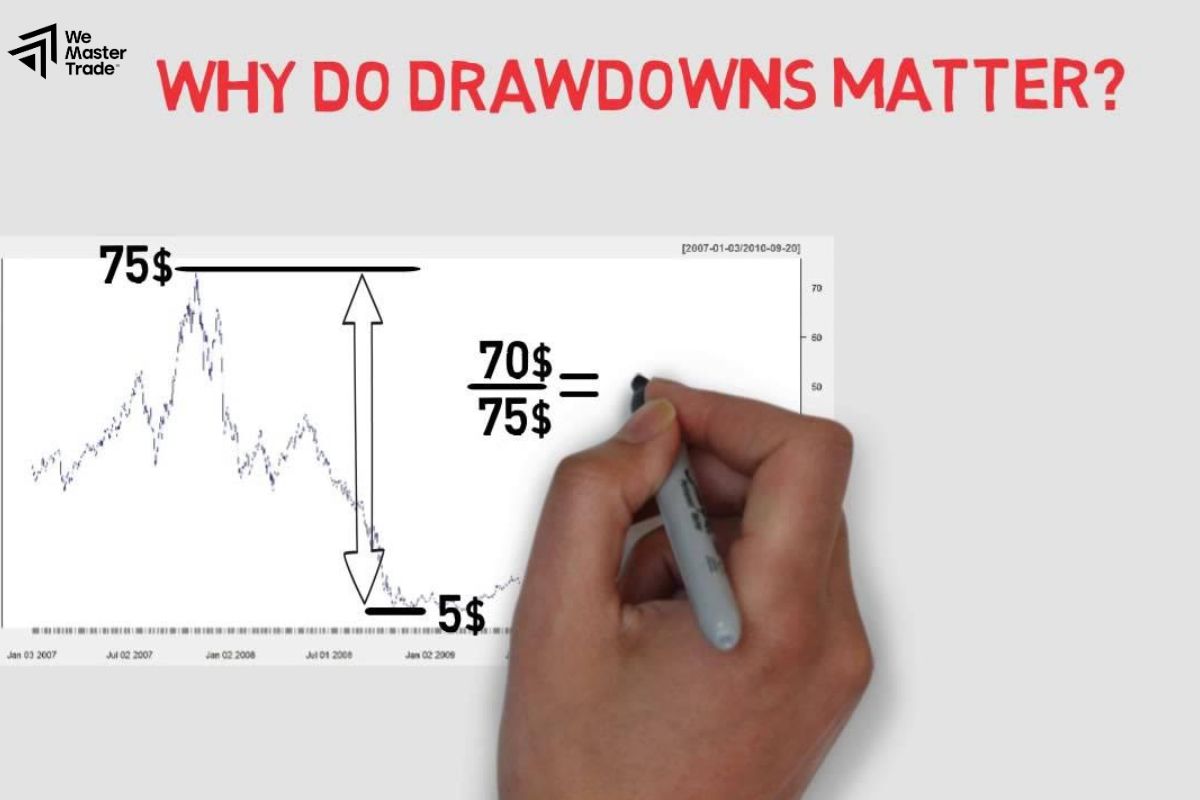

Drawdown (%) = [(Peak Value – Bottom Value) / Peak Value] × 100

Where:

- Peak Value: is the highest equity level reached before the account started to decline.

- Bottom Value: is the lowest equity level during that decline cycle.

Example

Suppose your account has a balance of:

- Highest peak reached: 10.000 USD

- Then decreased to: 8.000 US

Apply the formula:

Drawdown = [(10.000 – 8.000) / 10.000] × 100 = 20%

This means that during that period, your account lost 20% of its highest equity level – this is the drawdown level you need to monitor and control.

How to Minimize Drawdowns When Trading

Every trader will experience losing streaks, but what matters is how you manage them. Mitigating the drawdown index not only protects your capital but also maintains your psychological stability. Here are some effective ways to realistically limit drawdowns:

Trade with the right volume

Lot size management is the key to minimizing risk. Don’t let greed make you place orders that are too large for your available capital. A moderate volume will help you avoid serious account losses, thereby keeping the drawdown index at a safe level.

Always use stop-loss

Ignoring stop-loss is one of the mistakes that causes many traders to “burn their accounts”. A reasonable stop-loss level not only helps you protect your capital, but also prevents the drawdown from spreading uncontrollably. Determine the maximum risk for each order in advance, which should usually not exceed 1–2% of the total account.

Diversify strategies and markets

Don’t rely on a single currency pair or strategy. By distributing risk across different trading instruments and methods, you will minimize the impact when a part of the market moves unfavorably. This is an indirect way to control the drawdown index of the entire account.

Pause when drawdown exceeds personal limit

If you notice that the drawdown has exceeded the allowable level, pause trading. Re-evaluating the system, psychology and market conditions is necessary before returning. Don’t let emotions make you “hold losses” or take revenge on the market.

Trading with discipline and a clear plan

Adhering to the proposed trading plan helps you avoid impulsive decisions, the leading cause of drawdown. Set clear rules and limits for each trading session, from volume, entry/exit points to maximum loss for the day.

Conclusion

In short, the drawdown index is an indispensable tool in the process of evaluating trading risk and performance. Understanding how to calculate, the causes of drawdown and how to control it will help you protect your account, maintain stability and sustainable development in the financial market. Whether you are a newbie or an experienced trader, do not underestimate the role of indicators in your money management strategy because sometimes, survival is more important than profit.

See here: