Understanding the spread is important for anyone involved in forex trading. The spread, which is the difference between the bid and ask price of a currency pair, directly affects your trading costs and overall profitability. Whether you are a beginner or an experienced trader, knowing how the spread affects your trading can help you make better decisions and optimize your trading strategy. Read on below!

What is Forex Spread?

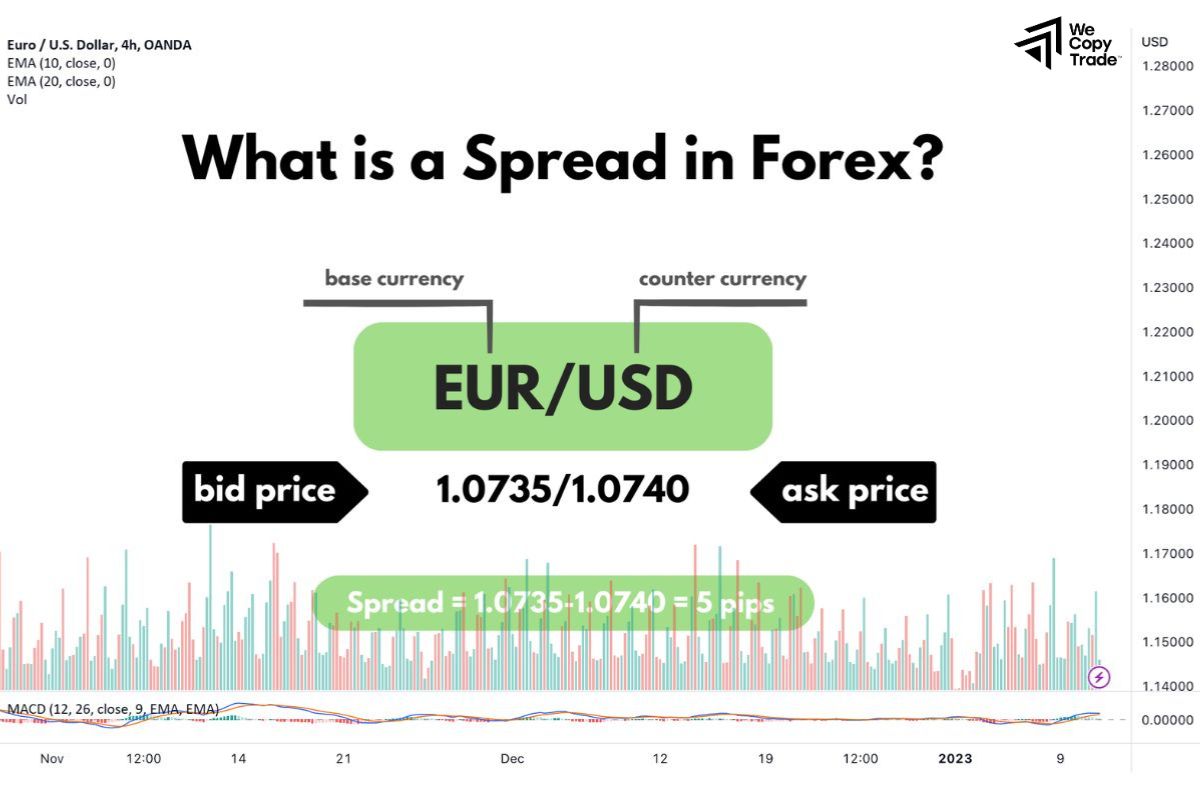

In Forex trading, the spread refers to the difference between the bid price and the ask price of a currency pair. Here’s a quick breakdown:

- Bid Price: The price at which you can sell a currency pair.

- Ask Price: The price at which you can buy a currency pair.

The spread is essentially the cost of trading and is how brokers make money from the trades without charging a direct commission.

For example, if the EUR/USD pair has a bid price of 1.1000 and an ask price of 1.1005, the spread is 5 pips (0.0005).

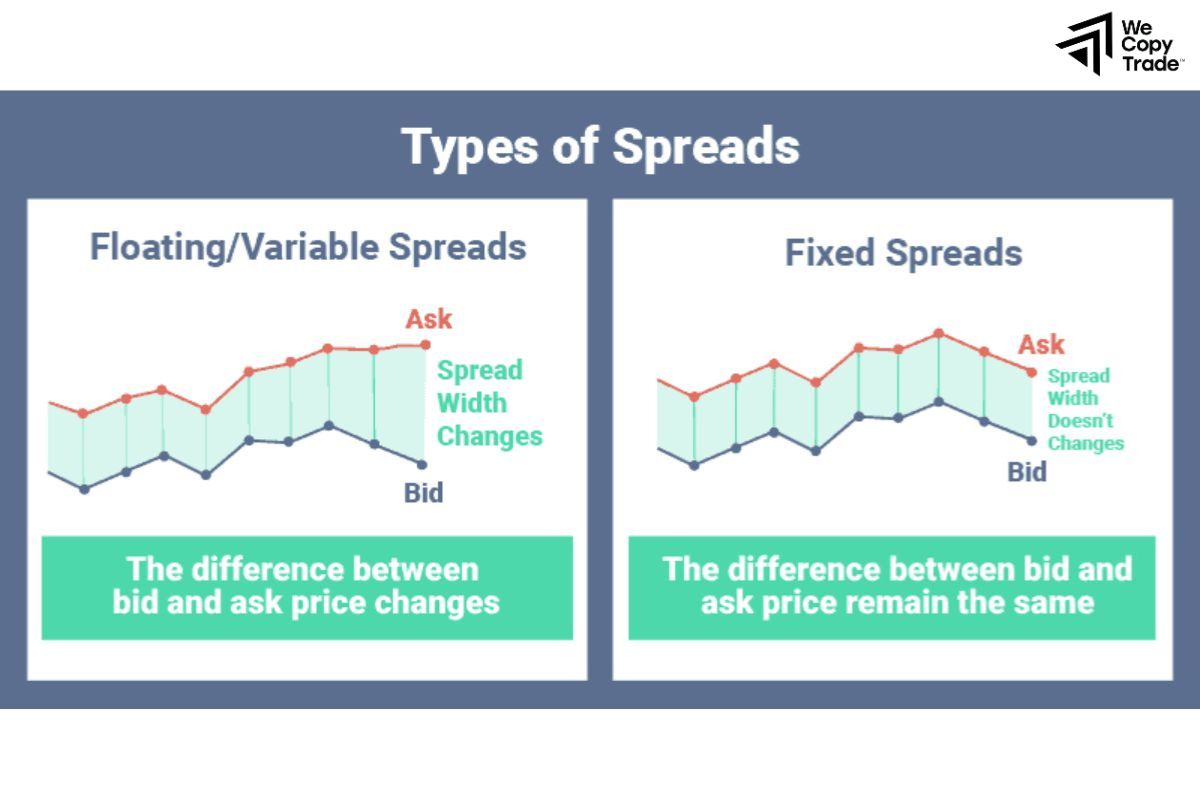

Spreads can be either fixed or variable:

- Fixed Spread: The difference between the bid and ask price remains constant regardless of market conditions.

- Variable Spread: The spread can change depending on market volatility and liquidity.

In general, tighter spreads (smaller differences between the bid and ask price) are more favorable for traders as they reduce the cost of entering and exiting trades.

See more:

- Mastering Pip Forex – How to calculate Pip in the Forex 2024

- What is Margin? The best margin stock calculation formula

- What is Financial Leverage? How to calculate the Leverage?

How Forex Spread Affects Trading

The Forex spread significantly impacts trading in several ways:

Trading Costs:

- The spread represents the cost of opening a trade. A wider spread means higher trading costs because you need a larger price movement to cover the cost and make a profit.

- For traders, especially those making frequent trades (like scalpers), a tighter spread reduces the cost and can lead to better overall profitability.

Trade Execution:

- In volatile markets, spreads can widen, increasing trading costs and potentially affecting execution. Wider spreads can lead to slippage, where the executed price differs from the expected price.

- During times of high liquidity, spreads tend to be narrower. In contrast, during periods of low liquidity or high volatility, spreads may widen, affecting trade execution and cost.

Trading Strategy:

- Scalpers rely on small price movements and need tight spreads to make a profit. Wider spreads can erode potential gains from rapid, small trades.

- Day traders often prefer brokers with tight spreads to minimize costs over multiple trades throughout the day.

- Swing traders, who hold positions longer, may be less affected by the spread compared to scalpers or day traders, but lower spreads still help reduce overall trading costs.

Types of Forex Spread

Forex spreads can vary based on different factors, including market conditions, broker policies, and trading platforms. Here are the primary types of Forex spreads:

Fixed Spread

- The difference between the bid and ask price remains constant regardless of market conditions.

- Provides stability and predictability in trading costs, as the spread does not change. However, brokers may widen the spread during periods of high volatility or low liquidity.

- Traders who prefer consistency and want to avoid sudden changes in trading costs.

Variable Spread

- The spread fluctuates based on market conditions, such as liquidity and volatility.

- Can be narrower during high liquidity and normal market conditions but may widen during periods of low liquidity or high volatility. This type of spread often reflects real-time market conditions.

- Traders who are comfortable with variable costs and are looking to benefit from tighter spreads during stable market conditions.

Commission-Based Spread

- Brokers offer lower spreads but charge a separate commission fee per trade.

- The overall cost of trading is transparent as the commission is separate from the spread. This model can be beneficial for traders who make high-volume trades.

- Active traders who prefer lower spreads and are comfortable paying a commission for each trade.

Zero Spread

- The bid and ask prices are the same, effectively meaning there is no spread.

- Typically associated with brokers who charge a commission per trade instead. Zero spreads can provide a clear and direct cost structure.

- Traders who prefer a transparent cost structure and are okay with paying a commission.

Dynamic Spread

- A combination of fixed and variable spreads where the spread is fixed within certain market conditions and becomes variable during periods of high volatility or low liquidity.

- Provides a balance between predictability and responsiveness to market conditions.

- Traders who seek some level of stability but are also aware of potential changes in spread during volatile times.

Conclusion

In conclusion, understanding the concept of spread in Forex trading is crucial for optimizing your trading strategy and managing costs effectively. Whether you encounter fixed, variable, or zero spreads, each type impacts your overall trading expenses and strategy performance differently. Therefore, stay informed about how spreads can fluctuate based on market conditions and leverage this knowledge to make more strategic trading decisions.

See now: