Margin also known as Margin Trading is a familiar term in the field of stock investment. But what exactly is margin, and how does it play a role in optimizing the efficiency and use of an investor’s capital? Let’s explore the detailed concept and the best ways to use margin effectively through the article below!

What is Margin?

Margin is a financial term that refers to the amount of money or percentage required to open or maintain a trading position in financial markets, such as stocks, forex, or commodities. In simpler terms, margin is the amount of money you need to deposit to trade or invest with a larger sum than you actually have. When you trade with margin, you are borrowing money from a broker to expand the size of your trade.

For example, if you want to buy stocks worth $10,000 but only have $1,000 in your account, you can use margin to borrow the remaining amount from the broker. However, using margin also involves higher risks because if your trade does not go well, you could lose more than the amount you initially deposited.

See now:

- What is a Currency Pair? A Detailed Guide to Currencies in Forex Trading

- What is Forex Spread? What are the Impacts and Types of Forex Spread?

- Mastering Pip Forex – How to calculate Pip in the Forex 2024

How much money can an investor borrow, and what is the leverage ratio?

The amount of money an investor can borrow and the leverage ratio depend on the broker’s margin requirements and the specific financial market or asset being traded. Here’s a breakdown:

Margin Requirements: Brokers set margin requirements as a percentage of the total trade size. For example, if the margin requirement is 10%, you would need to deposit 10% of the total trade value, and you could borrow the remaining 90% from the broker.

Leverage Ratio: The leverage ratio is the ratio of the total value of a position to the margin required. It reflects how much you can control with your margin. For example:

- If you have $1,000 in your account and you use a margin requirement of 10%, you could control a $10,000 position. This gives you a leverage ratio of 10:1 (or 10 times your margin).

- With a 50% margin requirement, you could control a $2,000 position with $1,000, resulting in a leverage ratio of 2:1.

Example:

- Margin Requirement: 20%

- Leverage Ratio: 5:1 (since 1 / 0.20 = 5)

Are all stocks eligible for margin borrowing?

Not all stocks are eligible for margin borrowing. Eligibility depends on the brokerage’s policies, the type of stock, and risk factors. Stocks listed on major exchanges like NYSE or NASDAQ are usually more likely to be marginable, while those with low liquidity or traded on OTC markets might be restricted.

Does margin borrowing accrue interest?

Yes, margin borrowing accrues interest. Brokers charge interest on the borrowed amount, which can vary based on the loan size and broker. Interest is typically charged daily, compounded, and billed monthly. This cost can affect your overall returns.

The role of Margin in investing

Margin plays a significant role in investing by allowing investors to borrow money to amplify their trading capacity. Here’s how it impacts investing:

- Leverage: Margin enables investors to control larger positions with a smaller amount of their own money, increasing potential returns.

- Increased Risk: While it can boost profits, margin also amplifies losses. If investments perform poorly, losses can exceed the initial investment.

- Flexibility: Margin provides the ability to diversify investments or take advantage of more opportunities without needing full capital upfront.

- Cost: Borrowing on margin incurs interest, which can reduce overall returns if the investment doesn’t perform well enough to cover the cost.

Concepts related to margin

Here are some key concepts related to margin:

Margin Account

A brokerage account that allows investors to borrow funds to buy securities, using their existing investments as collateral.

Maintenance Margin

The minimum amount of equity an investor must maintain in their margin account to keep a position open. If the account equity falls below this level, a margin call is triggered.

Margin Call

A demand from the broker for additional funds to bring the account equity back up to the required maintenance margin after it has fallen below the minimum level.

Leverage Margin

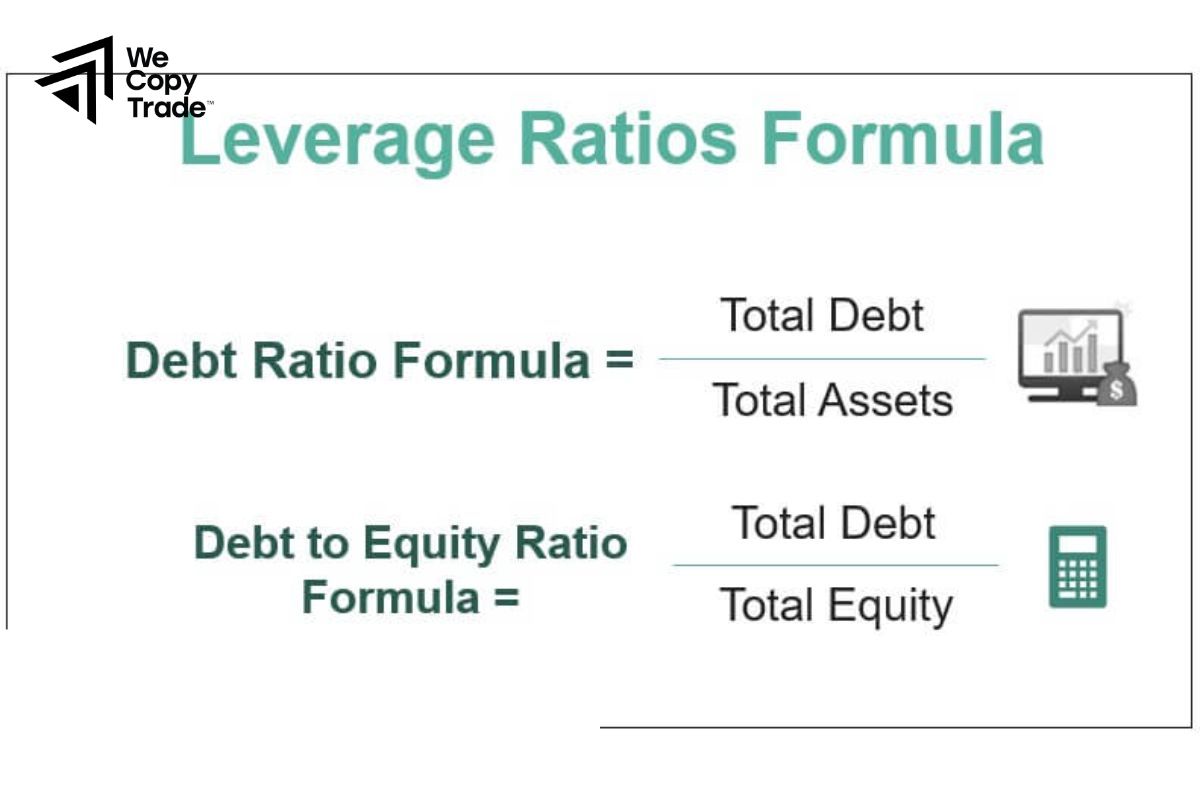

The ratio of the total value of a position to the margin required. It shows how much borrowing is being used relative to the investor’s own capital.

Margin Interest

The interest charged by the broker on the borrowed funds. This cost accumulates over time and affects overall investment returns.

The best formula for calculating margin stocks

Formula for Calculating Margin Requirement for Stocks:

- Calculate Margin Requirement:

Margin Requirement = Total Value of Position × Margin Requirement Percentage

Example:

- Total Value of Position: $10,000

- Margin Requirement Percentage: 20%

Margin Requirement =10,000 × 0.20 = 2,000

This means you need $2,000 in your margin account to open a $10,000 position if the margin requirement is 20%.

- Calculate Leverage Ratio:

Leverage Ratio = Margin Requirement : Total Value of Position

Example:

- Total Value of Position: $10,000

- Margin Requirement: $2,000

Leverage Ratio = 10,000 : 2,000 = 5:1

This means you are using 5 times leverage to control the $10,000 position.

When should you and should you not use margin?

Here’s a table outlining when you should and should not use margin:

| When to Use Margin | When Not to Use Margin |

| When you expect a high return and are confident in your investment strategy. | If you are uncomfortable with the possibility of significant losses. |

| When you want to capitalize on short-term market movements. | If the market is extremely volatile, which can increase the risk of margin calls. |

| To spread risk across different investments without tying up all your capital. | If you don’t have extra funds to cover potential margin calls or losses. |

| If borrowing costs are low and the potential return justifies the interest expense. | If you are uncertain about the investment’s performance or market conditions. |

| When you want to participate in larger trades or more investments than your cash alone would allow. | If you don’t have the time or resources to closely monitor margin positions and adjust as needed. |

How to use margin effectively to avoid account liquidation

To use margin effectively and avoid account liquidation, consider these strategies:

- Monitor Margin Levels: Regularly check your account’s margin levels and ensure they stay above the maintenance margin requirement.

- Use Conservative Leverage: Avoid using excessive leverage. Aim for a lower leverage ratio to reduce the risk of margin calls and potential liquidation.

- Maintain a Cash Reserve: Keep extra funds in your account as a buffer to cover margin calls and prevent liquidation.

- Set Stop-Loss Orders: Use stop-loss orders to automatically sell securities if their prices fall below a certain level, limiting potential losses.

- Regularly Review and Adjust Positions: Reassess your positions and margin usage frequently. Adjust your portfolio or reduce leverage if market conditions change.

- Understand Market Risks: Be aware of market volatility and how it can affect your margin account. Stay informed and prepared for market fluctuations.

Conclusion

In conclusion, understanding margin is crucial for any investor looking to enhance their trading strategies. However, it’s essential to use margin wisely, considering both the benefits and the risks involved. Due to regulations governing margin borrowing are designed to protect investors and ensure market stability, so be sure to familiarize yourself with these rules and manage your margin account carefully.